USDQ Coin Review | Meet the Stablecoin by the Platinum Team

What is a stable coin?

A stablecoin is a cryptocurrency, whose architecture enables its price to always equal the price of another asset. Most of the stablecoins are pegged to USD. The biggest names in cryptocurrencies are Tether, Gemini Dollar, USDQ, TUSD and others.

How do stablecoins manage to be so stable?

As opposed to other coins that float freely, stable cryptocurrencies require that each unit is backed with a unit of the fiat currency. For instance, Tether (USDT) pegs 1 USDT to 1 USD on the one-to-one basis. In this way, stablecoins are somewhere between cryptocurrencies and regular fiats. Tether is based on its own blockchain that is built on top of Bitcoin, Litecoin and Ethereum systems.

Although Tether is the biggest stablecoin, there's a number of concerns as to its operations. The biggest one is the continuing controversy as to the fiat reserves, which the issuer is supposed to store on the one-to-one ratio to the number of issued Tether units. The company has been saying that the audit will be done in the near future, but just several weeks ago it started to claim that it's not only the cash, but also loans to other companies that can be recorded as fiat reserves. These statements resulted in growing distrust among crypto enthusiasts.

Another project is TrueUSD (TUSD). It also pegs to USD. The difference with Tether is the openness to audits and transparency. The company is open to third-party audits, it publishes the duly verified reports on the fiat reserves it holds. In addition, users enjoy legal protections.

USDC is another stablecoin that was created by the famous cryptocurrency exchange Circle. Just as TUSD, if offers regulatory compliance and transparency. The big problem about all these systems is the fact that they enable authorities to seize users’ funds, which completely negates the very idea of decentralization and anti-censorship, on which crypto is built.

How do USDQ and Q DAO coins work within the ecosystem?

USDQ is a decentralized stable coin, which uses algorithms to offer higher stability and reliability. It's backed by Bitcoin (another top 10 cryptocurrencies will be added in future). The elegant system places all transactions on the blockchain and empowers users to execute cross-border and disintermediated transactions at any time and from any place. It's pegged to the value of USD, i.e. 1 USDQ always equals 1 USD. The ecosystem's design borrows heavily from fractional banking systems. In the nutshell, USDQ is a customer-facing stable coin and Q DAO is an internal "operational" coin; together they help create a stabilized safe haven for anybody who's looking to hedge against rampant volatility of crypto markets.

What makes USDQ stand apart

The main difference between projects like Tether and USDQ is complete transparency and openness in the inner workings of USDQ. All the data is easily accessible on the blockchain and there are no rumors or controversies as to the reserves held by the team, potential conflicts of interest or hidden agendas.

The CDС mechanics ensure that it's impossible to create fake units of USDQ, as smart contract can be activated only after an amount in Bitcoins is input. The development is being done completely transparent. Interested parties can review the smart contract, presented on the website. The audits and peer reviews were carried out to assure the highest quality of smart contract. The website-based scanner enables to track all the data about each and every transaction, including time, amount and collateral size

USDQ PRICE STABILIZATION PROCESS

The stability process is achieved by Q Boxes who will make the decisions based on the algorithms of the crypto asset sale should the price drop lower than the designated framework.

The Q Boxes influences the ecosystem by adjusting the human factors at the point of decision making.

The price pegging price in the contract is 1:1 at the dollar supported level but at the USDQ level, the token cost can be in the greater or lower side. Thus, the smart contract ensures 1 USDQ = 1 USD.

The other way to stabilize the USDQ token is also connected to the Q Boxes. As a result, the 1 USDQ in the secondary market will always be stabilized due to actions of traders and change of the number of USDQ which are in circulation.

Q DAO Token and Voting Process

By means of governance tokens Q DAO it is possible to vote and make decisions influencing all ecosystem. Each users' neural networks will be developing on their own pace and therefore the predictions they make will be different too. And if at some point most of Q Boxes, irrespective of the level of their proficiency foretold that, for example, the rate of cryptocurrency which is in pledge will fall and it is necessary to take actions to stabilize stable coin by increase in a rate of pledge, then this solution prediction will be brought up for voting where each holder of governance tokens Q DAO will be able to vote "against". If the owner of governance tokens Q DAO does not take part in the vote, his voice automatically becomes pro this decision. Thus, if most of the users voted against, nothing occurs and if for - the system changes.

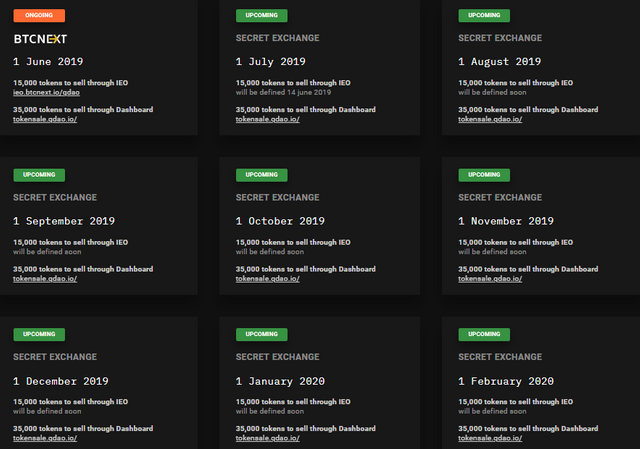

Roadmap

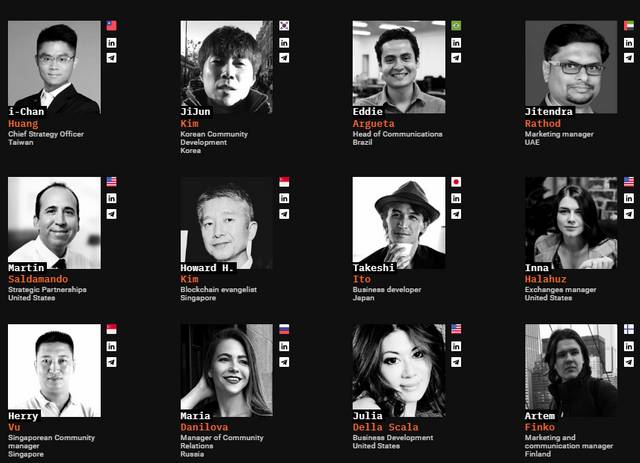

Management team

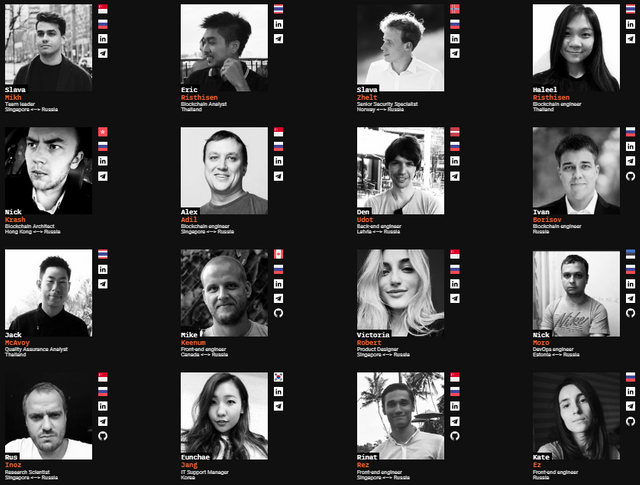

Engineering team

More info

Website :- https://usdq.platinum.fund

Telegram :- https://t.me/Platinumq

Kakao :- https://open.kakao.com/o/gfFhY2mb

BtcAlpha Exchange :- https://btc-alpha.comhttps://btc-alpha.com

Twitter :- https://twitter.com/FundPlatinum

Linkedin :- https://www.linkedin.com/company/platinumqdao/

BitcoinTalk :- https://bitcointalk.org/index.php?topic=5139238.0

Reddit :- https://www.reddit.com/user/Platinum_QDAO

Bounty :- https://bounty.qdao.io/ref/850-033-275