Ripple Technical Analysis

Details

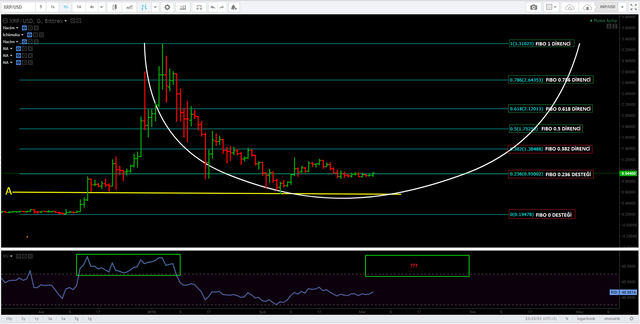

5th March Ripple Technical Analysis

The information and comments contained herein are not investment advice. Analyzes and evaluations I have done should be based on technical data

Outline

In summary ripple spent a very calm week this week

Scope of Analysis

I have prepared a chart daily and each candle represents 1 day

Tools

I usually use trend lines and important indicators to read the graphs. The RSI indicator comes at the beginning of these. I am viewing charts daily or 4 hours.

Results

The movements that Ripple has shown have not made any changes in the medium and long term, but on the other hand I think it is very important to recover strength. The FIBO 0.236 ($ 0.93) was also very important area for resistance and support. On the last day of the week ripple broke these levels upwards. It is very important for the future to be permanent on this level. If the bullish movement continues, there is an intermediate resistance at the level of $ 1.19. The FIBO on this resistance is expected to be at 0.382 ($ 1.38) level resistance. The up direction of the RSI indicator is supportive in terms of upward direction. The RSI value is around 46, indicating that purchases are not over. In this phase, RSI must be in our watch. Currently, the FIBO 0.236 ($ 0.93) level is not the first support level. If sales are below this level, we will not be able to enjoy the next support trend.

Example Point 1

A stagnant week for Ripple was behind. When we looked at the chart, it was the first such a quiet week for ripple after ten weeks. At the beginning of the week, the ripple of $ 0.89 went to $ 0.88 -0.94. The week closed at $ 0.94. This was the highest level of the week, with a 5% increase on a weekly basis.

Example Point 2

In Ripple we see the most stagnant figure of the past week. The weekly FIBO started below the level of 0.236 ($ 0.93), ripple, tried to pass this resistance in the middle of the week and was not successful. It's back to the starting price again. During the week the price movement continued below this level. However, if we look at the last day of the week, we see the FIBO breaking up 0.236 ($ 0.93).

Example Point 3

Ripple is the direction in which the graph will go out, we can have a 0.25 $ movement in that direction .. but the market will be recovering and -1.85% will contribute to the RSI position ripple so we can experience an increase of 0.25 $. target $ 1.15

Posted on Utopian.io - Rewarding Open Source Contributors

Your contribution cannot be approved because it does not refer to or relate to an open-source repository. See here for a definition of "open-source."

Dear @gokselgok35 while the Ripple blockchain implementation is an open source project, the token market price on it's own is not related to that. TAs are not in the scope of Utopian.

You can contact us on Discord.

[utopian-moderator]

Hey @crokkon, I just gave you a tip for your hard work on moderation. Upvote this comment to support the utopian moderators and increase your future rewards!

@gokselgok35, Approve is not my ability, but I can upvote you.

thx bro

You got a 17.10% upvote from @upmewhale courtesy of @gokselgok35! Earn 90% daily earning payout by delegating SP to @upmewhale.

thanks @upmewhale

Release the Kraken! You got a 16.54% upvote from @seakraken courtesy of @gokselgok35!

Great post!! I appreciate all of the information and I plan to be putting together a post about Ripple in the near future. If you get a chance, check out my post I just made about Nexus. I would be interested in your feedback. Thanks!! #Upvoted

https://steemit.com/bitcoin/@cool-mike/nexus-the-future-of-cryptocurrency

Thank u @cool-mike.

I read your post about nexus. Good post,liked it.

Continue observing and investigating.