Is this why the price of STEEM is struggling? STEEM Withdrawls 2017

2017 was a fantastic year in the world of cryptocurrency. We have seen Bitcoin prices go above $10,000 and millions raised through ICO’s. So why then has the price of STEEM not experienced some of the same growth as the major coins?

Yesterday I did a post on Steemit Investors 2017

https://steemit.com/utopian-io/@paulag/steemit-investors-2017-steemit-business-intelligence

In this analysis I found that 14% of active new users registered in 2017 have invested into Steemit by transferring either STEEM of SBD via an exchange to Steemit.

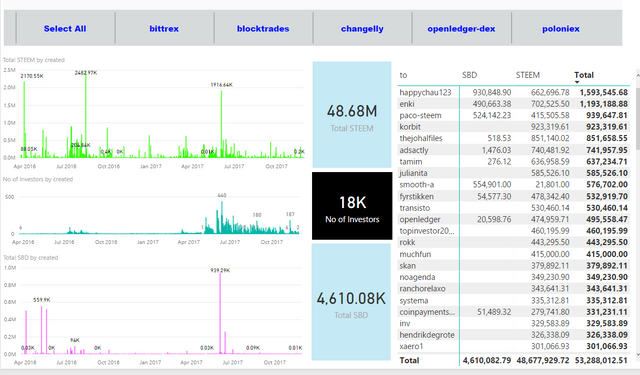

The analysis yesterday was based on users that registered in 2017. I have now reworked this analysis to include all account. The aim of this was to see how much in total was transferred into Steemit via the exchanges

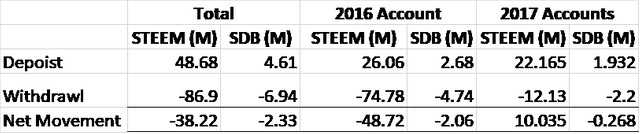

48.68M STEEM was invested into Steemit and 4.61M in SBD. If you are unsure about the rest of the data in that visualization, please do read yesterday’s post.

After I did yesterday’s posts the thought crossed my mind that if people are investing in Steemit, then why is the price of STEEM not seeing good gains?

Basis of Analysis

I connected to @arcange SteemSQL database using Power BI.

First I connected to the Accounts table so that I could have access to the account creation data.

The second table I connected to was the TxTransfers table. I used the following SQL query

SELECT *

FROM TxTransfers (NOLOCK)

WHERE [to] in ('blocktrades', 'bittrex', 'changelly', 'openledger-dex', 'poloniex')

and timestamp >= CONVERT(datetime,'01/01/2017')

After which I carried out further transformation steps on the data and calculations using DAX.

Findings

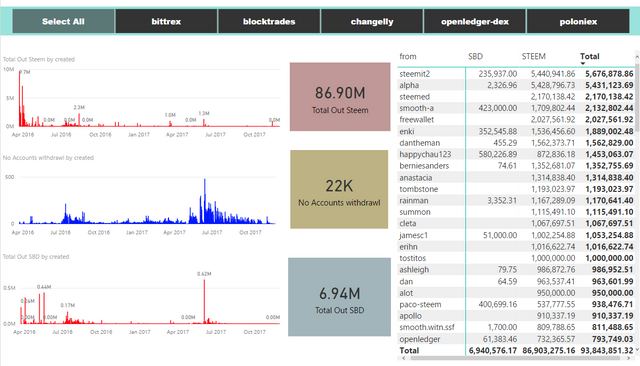

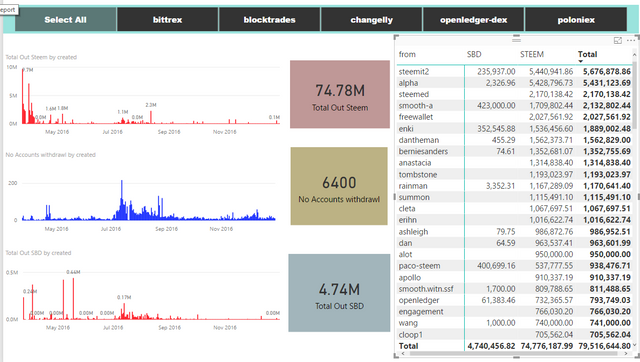

The total withdrawn from Steemit in 2017 to date is 86.90M STEEM and 6.94M SBD.

On the top left the red bar chart shows the amount of STEEM withdrawn based on the date the account was created. On the bottom left also in red, shows the mount of SBD withdrawn based on the date the account was created.

The bar chart in blue shows the number of unquiet accounts making a withdrawal based on the date the account was set up.

On the right you can see a list of accounts sorted by the highest withdrawal amount.

I am not surprised to see that the higher value withdrawals are from the older accounts on Steemit but I was surprised to see that the number of accounts making withdrawals increased significantly in May 17.

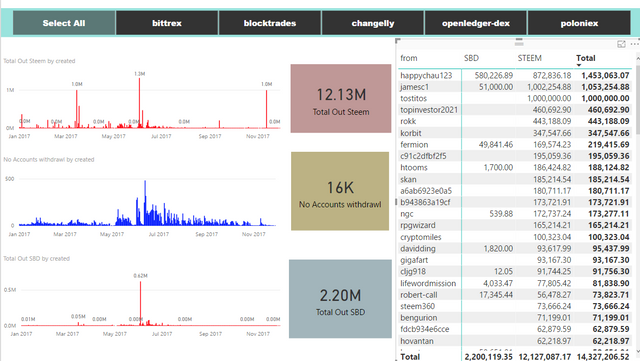

Lets take a closer look. First I have filtered the data to show only accounts set up in 2017.

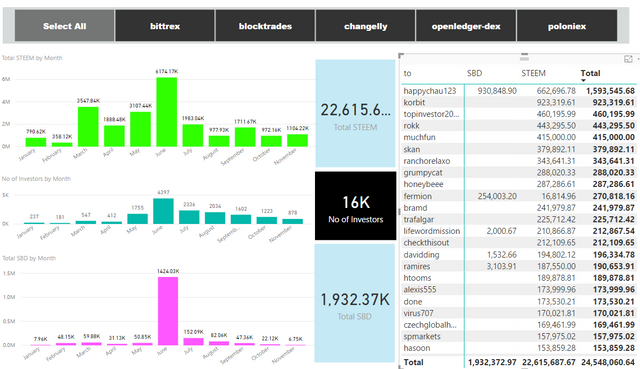

Taken from yesterday’s report, here is the transfer IN data.

Now I have filtered the data to shown only accounts set up in 2016

And I have also reworked yesterday’s data to show account set up in 2016 for transfers IN.

Let’s do the Math

To put that in a different perspective, for every 1 STEEM invested into the platform 1.27 STEEM is taken out. For every 1 SBD invested 1.98 is taken back out.

The positive side of this is that for accounts set up in 2017, so new investors, for every 1 STEEM invested only .45 STEEM is taken back out.

Conclusion

I am not a trader and I don’t claim to know much about stocks or crypto. I also understand that there is a lot of STEEM held on exchanges and not included in these calculations.

However this data represents Steemit users and their willingness to invest in steemit and provide liquidity.

It only takes a quick look at https://steemwhales.com to see how much STEEM is held by the whales with accounts created in 2016. This is all available for power down. If the rate of withdrawals continues to exceed the rate of investment then I believe the price of STEEM will continue to fall and I don’t think the SMTs will help.

Right now, we need investors to stay put, or at least ensure the rate of new investment to Steemit is at a higher level than the rate of withdrawals.

I can understand early investors wanting to take profit, but Steemit is still very new and putting it in a business perspective, start-up capital is still needed.

Maybe it’s even time to consider changing the rules for power downs and withdrawals?

What are your thoughts and feedback on this data, please do leave your comments below

I am part of a Steemit Business Intelligence community. We all post under the tag #BIsteemit. If you have an analysis you would like carried out on Steemit data, please do contact me or any of the #bisteemit team and we will do our best to help you...

You can find #bisteemit on discord https://discordapp.com/invite/JN7Yv7j

Shout out and thanks to @arcange for keeping and maintaining the steemsql database

Posted on Utopian.io - Rewarding Open Source Contributors

I believe it is healthy for the ecosystem when Steem is changing hands. When a whale sells his stake, this stake gets bought up by several new investors. Steem works on a Proof of Brain algorithm, which thrives when there are more users. So the spreading of Steem is actually good, even when this dampens the price on the short term

This is an excellent point. Steem distribution is extremely unequal at the moment, and the whales powering down is very good for this platform. That Steem will end up in many more hands, or many more brains, if you want to look at it that way, each being a new neuron added to the super-brain that is the decentralised autonomous Steem community.

I get this, and do agree to an extent. yes we need the steem in more hands but we also need liquidity

Technically more steem going to the exchanges builds liquidity. What we need is demand.

I also believe it is health for steemit to change hands, the problem is the stakes are not fully reinvested into steemit, as can be seen by the withdrawls vs deposits. so how much is held on exchanges, and why is it there and not on steemit?

There are traders and investors. Steem that is not powered up does not receive interest and does nog give voting power. There is a price to this. It actually costs money to keep your Steem just as Steem.

With there being more liquid Steem available then before a higher percent of the market is basically saying that it is currently more profitable to trade than to power up. Or they do not know what to do with the Steem Power.

This ecosystem is quite new and a lot of things are still being figured out. Aside from self voting it is quite difficult to just start turning your voting power into more Steem. Traders are mostly looking for short term gains while investors buy up the lows and are currently stabilising the price around $1.

I personally think this $1 mark is the rough bottom for the new run up. Maybe starting early next year after the release of the smartphone app, HF20 and SMTs

If you look at the total market cap over time you see that there was an inital hype and after that the pice bottomed out and stabilised and go for another cycle, with a higher high than before and a higher bottom then before. This cycle will repeat itself over and over and is based on human emotions

I think that people withdrawing Steem is a good thing, it's being used, and in order for it to succeed it has to be. I don't think the price of Steem is struggling. We are right on the cusp of having some awesome updates to the official front end, all sorts of awesome develpment on 3rd party apps, we're just young as a token, and as a community. It's not really fair to compare Steem to btc, when btc has been around for a lot longer. Since btc is transferrable into any currency, digital or fiat, it's king. Untill another currency can do the same, there's no point to being upset about it.

Steem is about 10x where it was this time last year... I don't think our price is struggling as much as we're just breaking out of our cocoon.

If the steem network is being used to transfer money, then it is serving one of its functions as means of transferring money (sbd in this case).

What Paula is saying is that powering down (whose only intent is to ultimately trade that steem out for other coins) will end up flooding the exchanges who provide liquidity, with more steem. If there are not enough buyers and too much steem sitting on exchanges, the value will go down if their steem grows faster than user demand looking to enter the steem.

At the same time steem is developing and growing trying to increase value. This can only be done of steem isn't being dumped into the market.

I like the article, but I think it kind of misses the point. Steem's main strengths are propagation and ease of entry. The price doesn't really matter this early.

@inquiringtimes is right in pointing out that BTC has been out far longer, and this creates the illusion that it's doing better than Steem. It isn't. Steem has far more potential at the end of it's first decade than BTC is showing at the end of it's first.

Also keep in mind that Steem is inherently inflationary to a fairly large degree, so can't be meaningfully compared to an exclusive, deflationary cryptocurrency like bitcoin. The fact that Steem is mostly holding its value despite the fact that more is created every day says something extremely positive about the currency's direction.

If you were here a year ago then you remember that at one point (for several months, maybe more) Steem was dropping like a stone in water. Now we've reached our first stabilization and, even if a significant portion of the first whales leave, I have full confidence that Steem will recover long term. It's built to do so.

The markets just don't matter as much with Steem as they do with BTC because Steem is aimed at being a social cryptocurrency with wide propogation. When enough people are using it, investors will come knocking in droves.

Exactly. This is a long term game. I'm not worried about the price of Steem at all. This long exhalation was always going to happen. Once the whales cash out, and that Steem gets bought up by many more users, they will be much more likely to hold on to their smaller SP balances. This is a natural cycle in all crypto. Long fractals. It just means that when the price spike does come, it will be extremely fast and violent.

This is a long term game, and steem does need to change hands and the power be distributed among a wider base

Lets add in this point, if the price of steem goes up, so does the vote value. New people coming to steemit have been seeing 0 on their vote given. This is not very motivational.

I do think the problem here is people's lack of willingness to invest in Steem rather than any problem with the system. At the moment anybody can put $50 into Steem, that's literally pocket change, and as the statistics stand, that already puts them into a higher bracket of users than the majority, who have nothing. With just 50 SP you can see your voting power have a real effect, especially if fully utilised daily and the rewards powered up. But most people don't do that. Even if the Steem price goes up the proportions won't change. It will still take the same amount of money to buy a proportional level of voting power.

Thank you for your detailed analysis though, it's very interesting and much appreciated!

$50 is not pocket change to many many users here. It really depends on where you are from.

Yes, indeed! $50 can represent a big chunk of cash!

Spot on. The ease of entry is so incredibly important. When you register Steemit sets the user's wallet up and they are good to go. That is HUGE. Try using LBRY. It's a pain in the ass for the non technical user.

STEEM has been incredibly stable compared to most alts for the past 8 months, it hasn't gone up a lot, hasn't gone down a lot in terms of USD. BTC is a different story.

What I love about Steemit, aside from the blogging and community, is the ability to get my rewards 50/50. Then I can invest at least half back into the platform and take the other half to do with as I please. This was another genius move.

Steemit is ahead of it's time regarding crypto social media and we are all early adopters so HODL.

Yep, total agreement. You're right: the 50/50 system is a spark of real genius, though maybe a subtle one that many people don't fully appreciate.

I have a tongue and cheek way if describing this: 'hunger proof'. Take the SBD to supplement your income and know that the rest is out of your reach unless you're willing to wait a significant amount of time for it.

Even if some immediate concern is up (bill is due, budgetary mishaps, or even an extreme case where you were literally starving (hungry) and your judgment was at its most altered), you aren't tempted to power down.

It's better than savings, and people are going to realize this.

While i think the ease of entry is something that steem shines on. I dont think it has a much of a primary effect right now, as it will later in the game. Think of it this way, if there was an EXE file that you could run and mine btc back in 2009, why didnt anyone do it since ease of entry was that great?

This is a rehtorical question, because back then BTC didnt matter. Just like right now, ease of entry doesnt really matter.

What does matter right now is a library of content. The better the content, the more likely the result will show up on google searches, and once a steemit article becomes atleast 1 in say every 10 searches a user performs, thats when ease of entry will become important. Right now, not so much.

Your explanation is very interesting @jenkinrocket. I am very interested.

Great work @paulag thank you for the contribution. It has been approved.

You can contact us on Discord.

[utopian-moderator]

Another excellent analysis. I think we have to find out what happened in May... just look at this chart:

light blue is SBD, green is US-$ and gold is Bitcoin

Here is Bitcoin alone for the same period:

As you can see, it was May '17, when the big surge of Bitcoin from 1,000$ to 10,000$ began.

My hunch is that this has something to do with two things:

Maybe a closer look at the newly created accounts that make a lot of withdrawals could help. If they are just set-ups, they won't have too many articles and comments on their account.

I should point out: This is just wild speculation;-)

Observed this graph today too.

Wha knows how SBD mass could triple in a mere month?

I thought that the price of SBD was partly controlled by the witnesses to keep it at 1:1 with the us$?

Really? Can you give me a source for that and can I refer to you when I ask around if this is true?

I got that impression from this

https://steemit.com/witness-category/@sc-steemit/steem-dollars-below-usd0-85-increase-in-apr-requested-to-all-witnesses-voters

Here's a simpler explanation, bots are harvesting the carcass of the Steemit rewards pool and transferring the bulk of it out when it is aggregated.

Its a parasitic arrangement that ends up with the value of Steem continuing to be depressed due to the gaming of the system.

You mean like Bitcoin is doing every day with their miners?

Your statement makes zero sense.

Bitcoin "miners" secure the network and process transactions.

Bots on steemit self-vote and vote for other bot-owned accounts, shunting the reward pool to their aggregation nodes. This also reduces the amount available for those actually producing content for the platform.

So your analogy is deeply flawed.

How do you explain the date when it apparently began?

Easy, the incentive to game returns intensified as cryptocurrencies rallied.

You can trade Steem for other assets, which were rising much faster than Steem ever did.

Ok.. my interpretation is more that the price went up like all the others but then something kicked in and the price went down again. But with the given information, both theories seem valid.

@paulag

First of all, thank you for a detailed reporting well done job.

I posted my own analysis for the last six months as being investors. It is a dismay report, losing 43.55% for STEEM while other crypto currencies enjoying 100%+ returns.

For example, for the last six months of trading.

Bitcoins 346% gain

Ethereum 40% gain not a bad return.

Dash 410% gain

Litecoin 231% gain

IOTA 239% gain

and many other, continue reading here.

https://steemit.com/bitcoin/@yehey/bitcoin-is-not-the-highest-earner-in-cryptocurrencies-steem-loss-43-44-since-june-2017-gains-losses-report-of-top-20

I agree we need more investors, banks, credit/financing companies to help move STEEM to the next level of growth.

I'm looking forward to move to the next level, we are stagnant for quite some time now.

Cheers,

@yehey

Very interesting analysis, thank you Paula!

Which tool did you use for visualizations, Tableau?

I've been interested in Data Analysis for at least one year, learning and studying by myself. And now, in Steemit I'm having my first contact with blockchain and cryptocurrencies, something really fascinating. Started just 3 weeks ago.

When I read this:

it was :O like music for me, my two passions together <3

Now I'll follow you and will be checking the #BIsteemit content.

Thank you again :)

I use Power BI :-) looking forward to seeing you over on #bisteemit

On just the motivation side of it....steem is setup for withdrawal then contribution. Steemit is the only place you can come and earn money in crypto from scratch by blogging and curating.

The that money can be taken to do whatever with, pay bills. Buy some BTC that is flying.

On the flipside the price of steem isn't doing much so there is no motivation for gains there in addition to the fact that it can just be earned from posting and curating, thus less motivation to invest in it.

I bought steem once back in 2016 and earned the rest of my SP posting. I have bought every other crypto once. I was able to build a position in Steem without investing dollars.

Its the blessing and curse of steemit.

Excellent analysis, thank you!

Since our reputation is as a pay for posting platform, people look to supplement their income and will sell. That downward pressure needs to be balanced by others investing. I think smt's will bring a lot to the table in this regard!

The power down process is already too stringent, imho, and should NOT be made even more so. Where else is your money tied up like this? If you invested in a bank cd, you could pay a penalty to withdraw all your money. Steemit does not have anything comparable. Powering up massive amounts means that you really believe in the long term prospects, barring any changes.

These two issues seem to be our main problems that will hopefully be helped by smt's.

Smt wont help at all in short term.

Some piece of tech which i doubt has any usecase at present day steemit could deal with 1-2 millions of steem withdrawing each month? You're kidding me.

Time will tell!

@hashclouds you bring some good points to the discussion

Good data analysis. I'm trying to get caught up on the current state of crypto currencies and steem in particular so I found this helpful and interesting. Are you thinking that the power down time should be increased, to say, 6 months? I'm not sure what other options there are to halt the tide of excess steem leaving (but I'm also not even close to an expert!).

I am no expert either, and to be honest I dont know if it should be increased after reading some of the other points made

I'd suspect that some whales who have made Steemit their full time job need to power down and will continue to do so. They're probably not inclined to buy much again, so they'll continue to earn from the inflationary currency and take their regular power down out for life expenses. This workflow is easy to maintain when content is regularly voted blindly with pre-set voting trails so people can stabilize this system. Nothing wrong with taking money out, but you're right that more is going out than coming in, and maybe this plays a part of it.

yes, people need money to live off at the end of the day, and I have no issue with this, but can steemit sustain this sort of sell off?

I'm inclined to think that the value would rise with more adoption in the next two years to offset this enough. I have no expertise to feel confident in that though.

However, I do sense and see that there's a decent portion of users who act heavily in their own personal interests alone, as interpreted by their outpouring of filler posts for votes to satisfy auto/voting trail rewards, met with offensively low amount of commenter engagement and upvoting. I think that this one way street mentality will fuel the issue you're raising because it's a selfish mindset of expecting, versus giving. Eventually one pool will drain out the other.