bitcoin

The use of cryptocurrencies has been falling since 2018 began and the speculative bubble over its value at the end of last year ended. At a global level, the trend is clear, but during the last few months several countries in the Southern Cone have begun to reinvigorate the sale of these assets, mainly Bitcoin, at the national level.

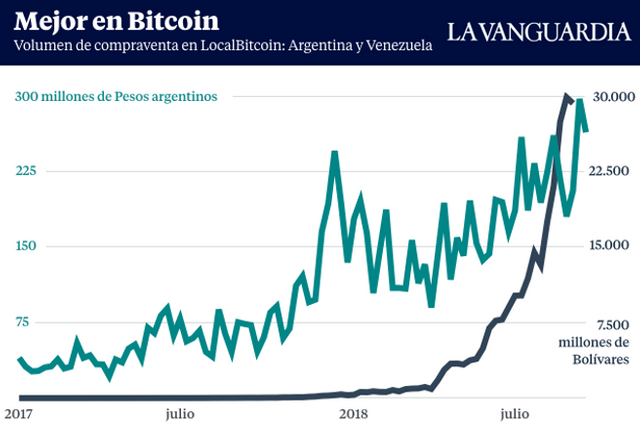

The governments of Venezuela and Argentina, both countries under different types of financial crises, are seeing their citizens choose each month more to exchange their national currencies for Bitcoin in search of better saving conditions or as an exchange facility afterwards for other official currencies .

This trend is reflected in the data of LocalBitcoin, a Finnish platform that allows users to exchange Bitcoin directly between them and offers a daily follow-up to the exchanges made from all the countries where it operates. With this tool we can access the microcosms of each country and observe the behavior of different markets.

In the last three months, the price of Bitcoin has remained relatively stable at around 6,500 dollars or 5,500 euros. But for a Venezuelan who exchanged their savings for Bitcoin at the beginning of July, he would have seen how his newly bought Bitcoin multiplied by 4 its value (in bolivars), being able to cope with recent inflation with better fortune. For someone from Argentina who made the same movement but with pesos, in the last three months he would have seen how his Bitcoin were worth 40% more (in pesos).