Online Video Meets Decentralised Business Models: What’s Next?

This article traces the influence of decentralisation in the world of online video distribution and its business models; presents alternatives brought up by blockchain applications; compares existing blockchain-based business models and offers a glimpse of this emerging market’s promise and potential size.

Decentralisation is at the root of the world wide web, purposely designed as an open and non-proprietary network. Even if the decades that followed Tim Berners-Lee’s creation saw the rise of tech companies, media conglomerates and regulatory institutions that arguably undermined the web’s original aim, the drive to decentralise remains a key propeller to major processes that shaped the internet as it is today (e.g. the transition to web 2.0 and the emergence of the sharing economy). As a demander of more than half of all internet’s traffic today, video consumption and distribution clearly evolve under the influence of this dynamics.

Video's share of global traffic. Source: Quartz / Atlas

Since the 2000s, the field is controlled by a small number of corporations who’ve recurrently pursued to restrain the adoption of peer to peer content distribution mechanisms. Content producers got used to creating value for these centralised institutions, offering their material in exchange for free hosting and, in some cases, a fraction of the revenue they generate. This habit shaped the topology of the modern video (and data) distribution landscape: in 2015, video’s share of global internet traffic already surpassed 70%, and more than half of all transatlantic data flows relied on private networks.

Facebook and Google account for practically half of all money spent on digital advertising worldwide — and I haven’t been able to think of other electronic or even print channels where such concentration was ever approached.

As Mr. Berners-Lee elegantly puts it:

“we don’t have a technology problem, we have a social problem”.

The P2P movement embraces cryptoincentives

Of particular interest for the field of video distribution are peer-to-peer file sharing systems, of which Bittorrent, with over 170 million monthly active users (close to twice as many subscribers as Netflix had at the end of 2016) is probably the best known example.

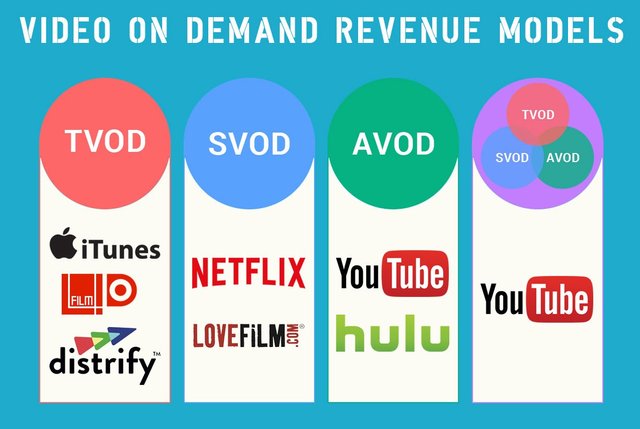

The BitTorrent protocol has been used as the basis for a number of content monetisation models and is useful to illustrate a spectre of them. In general terms, advertising-supported video-on-demand (AVOD) occurs where advertising is included as part of the content offered (i.e: Youtube); transactional video-on-demand (TVOD) happens when content is payed for whenever it’s to be watched or rented (think Apple’s iTunes); and subscription video-on-demand (SVOD) means a periodic fee is charged to allow retrieval from a catalog of content (for example, Netflix).

3 main video-on-demand monetisation models: AVOD, SVOD, TVOD.

BitTorrent has had difficulty in scaling on an enterprise level, from the Dropbox-like file sharing application BitTorrent Sync (later rebranded as Resilio) to the TVOD BitTorrent Bundles, until the addition of an ad supported free option made the Bundles program (rebranded as BitTorrent Now, now an AVOD platform) reach an audience of 200 million people. The Bundles service has benefited more than 30.000 publishers, which is certainly an achievement, but still far from Youtube’s estimated availability of over 100 million channels.

However, regarding any of these cases, what the BitTorrent protocol lacks is a proper incentive structure: users are not rewarded in a systematic way for providing bandwidth and storage capacity, so the network must depend on the goodwill of its participants to offer both of these.

There are a number of projects that aim to use a blockchain for adding such incentives and creating a sustainable, non-censorable peer-to-peer exchange of storage and bandwidth. IPFS, Swarm and Storj are a few. Their developments will the lower barrier of entry to the market of online video, potentially spawning business models that count on more or less decentralised mechanisms also for their governance, financing, content policies and social features. In the next section, we’ll present an overview of 9 examples of these.

9 blockchain-based ventures that either are or might evolve into a video-driven endeavour

As the diversity of content monetisation models shows, there is no consensus as to whether advertising is an essential piece of the business model or not: some fiercely defend it, while others choose to avoid it at any cost. Blockchain-based businesses that either are or might evolve into a video-driven endeavour can be classified according to their expressed view towards this issue:

AdChain is an Ethereum-based blockchain technology aimed at “significantly changing the way advertisers and publishers operate their supply chains and exchange ad impressions”. Blockchain “is used to provide a universal data set and common language everyone understands and trusts — becoming the single source of truth that all participants can access to work together and eliminate fraud”, which plagues the digital advertising industry.

AdBit is an operational “Bitcoin & blockchain empowered ad network working with a ‘Smart Bid Auction’ and a real-time payment system”, in a completely transparent fashion to advertisers and publishers.

HubDSP is an operational demand-side platform (DSP) “that allows buyers of digital advertising inventory to manage multiple ad exchange and data exchange accounts through one interface”.

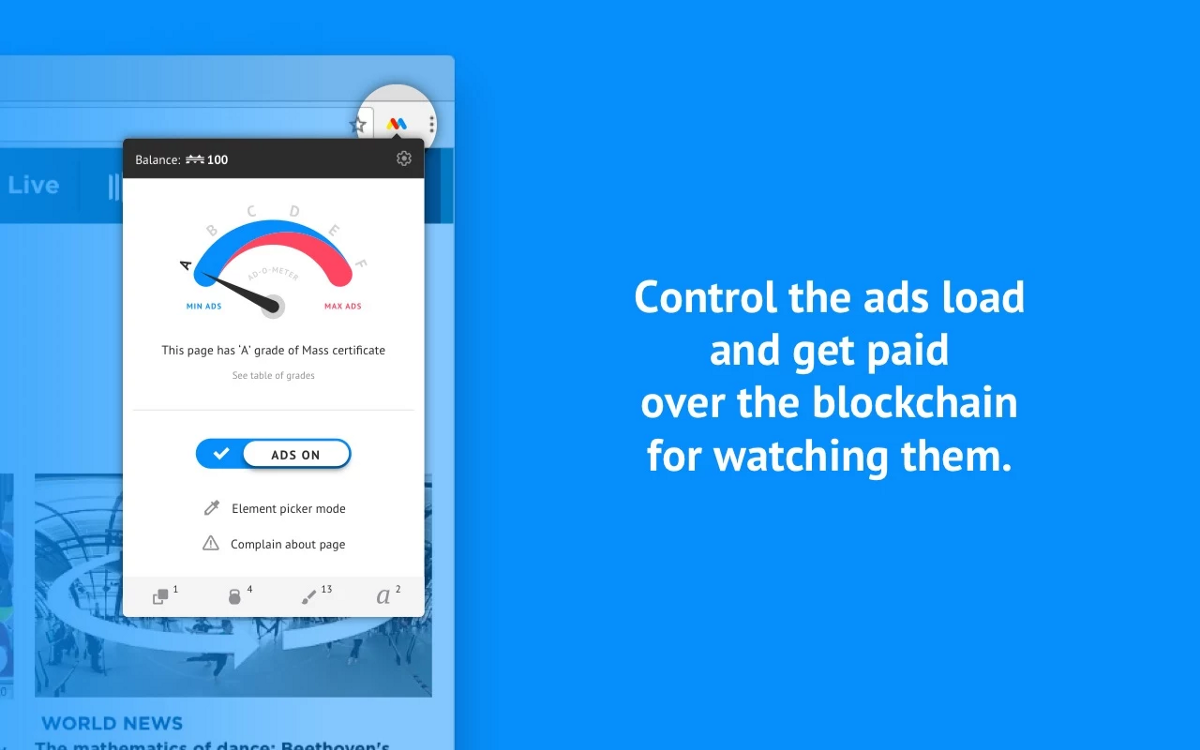

Mass Network is a “decentralised DMP” that allows users to monetise their traffic and behavioural data as much as they wish to, through a browser plugin that blocks ads as default.

A snapshot of Mass.network's browser extension.

Brave is an open source, “privacy-focused browser that blocks malvertisements […] and contains a ledger system that anonymously captures user attention to accurately reward publishers”. Basic Attention Token is the tokenised “unit of exchange between publishers, advertisers and users, derived from — or denominated by — user attention”.

Livepeer is a project that aims to deliver “a cryptoeconomically incentivized protocol and open media server for live video broadcasting, resulting in a cheaper, more scalable, and more decentralized live streaming solution than exists today”.

SingularDTV is “a blockchain entertainment studio, smart contract rights management platform and video on-demand portal” that has successfully fund itself through an ICO in 2016 and is under stealth mode development.

Synereo is “developing a series of tools designed to merge into a fully decentralised social network, further generalised into a universal, distributed computation platform. While the road is long, it is paved with applications offering functioning, real-world solutions that utilize AMPs, Synereo’s cryptocurrency, and provide them with backing”.

Synereo's first released application is called Qrator.

Steem is an operational “blockchain-based social media platform where anyone can earn rewards”, that has paid out more than one million dollars to its contributors.

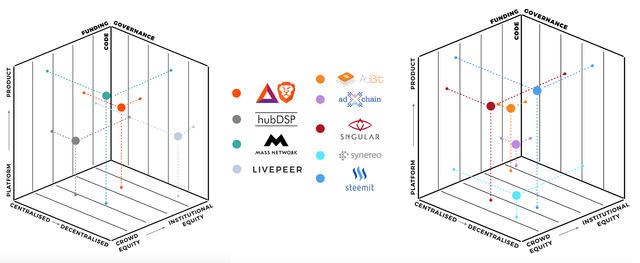

Of course, these 9 projects are at very different stages. A way of visualising this is by plotting them in a matrix according to their traction and funding. Most of our 9 picks are low-funded and haven’t gained much traction yet. On the right side of the chart, 4 outliers: Steemit, top-right, privately-funded, has +100K registered accounts and a market cap of dozens of millions of dollars. Brave, founded by father of the Mozilla Foundation and inventor of the Javascript, has generous private funding and a large user base to pave a market for its upcoming cryptocurrency. SingularDTV has raised U$7.5 million on its crowdsale and its on its development track with a growing community. Synereo has raised +4 million dollars and, after time consuming internal problems, recently began releasing its applications.

Comparing the amount of funding and traction in 9 blockchain-based projects. Some values are estimated, specially for funding.

Another way to compare this range of initiatives is by looking at more structural aspects, such as code orientation (from product to platform), governance mechanisms (from fully centralised to fully decentralised) and funding (from crowd equity to institutional equity). The matrix below draws inspiration from Doug Petkanic’s Token Powered Structural Rubix Cube:

A comparison of 9 blockchain-based businesses that either are or might evolve into a video-driven endeavour according to their “code orientation”, governance and funding.

It is noticeable that two of the most of the successful initiatives have code closer to product-level, usually built upon Ethereum technology (SingularDTV and the Brave Browser / Basic Attention Tokens), while Synereo and Steemit have a product-and-platform (application or portal + own blockchain) appeal.

Among our 4 outliers, low friction adoption is unanimous. For the end user, Steemit is a just web platform accessible through a URL. Brave is a browser, that, once in use, handles all the crypto work. SingularDTV is building a web portal and already has a web wallet. Synereo has chosen a simple tool to monetise on top of Youtube links as its first deploy. HubDSP, on the other hand, requires completely switching from another demand side platform in use by advertisers (or combine both, which hurts the purpose of managing all your inventory in one single place), and adChain, still in early development, offers a similar prospectus.

Besides the ease to use (choosing to build “on top of” something already widely adopted, such as the browser and its features), another common trait among the 4 selected businesses is their strong imposition when it comes to the monetisation model. Think of it:

Steemit is adfree by principle, and operates under a hidden transactional model (you don’t pay for retrieving content, but upvoting and interacting with posts ends up diverging revenue to their authors from a collection of sources, whom you might be one of). On it, creators have no access to a subscription-based monetisation model or some ad-supported feature that might make their audiences earn even more rewards. SingularDTV has imposed a SVOD model from its beginning. Synereo has always been against ads, and Brave is the one that seems a little more flexible in this sense, by blocking ads by default, but allowing doses of it to come through according to user preferences.

Evidently, these variations reflect not only different ideologies but also distinct target audiences (adChain caters to advertisers, so a basel model on ads is a must; SingularDTV aims at science fiction enthusiasts generally used at subscribing for content). An extra dose of flexibility, though, could be valuable for whichever intended public: whether you target advertisers, publishers, content curators or data farmers — why not let them decide how they want to monetise their stuff and pay for others’? Isn’t distributing the power of choice a core promise of decentralisation?

As a remark, I don’t believe these models are predatory to each other. Instead, they constitute an array of community hubs, targeting different segments, orbiting the core of this embryonic ecosystem that engulfs blockchain-based video-on-demand and cryptoadvertising. Most future developments, wherever they come from, will benefit various players and push the ecosystem towards collective maturity: adChain’s ledger for ad impressions (reportedly being developed with resources from Consensys, under the support of the Enterprise Ethereum Alliance) might serve a number of AVOD platforms. Identity solutions can be commonly leveraged. Tokens can be interoperable, and one can even think of a sectorcoin — but that’s already topic for another article.

Market Potential

This article’s last exercise is to estimate blockchain-based video-on-demand market’s size.

The field is still tiny in comparison to the market of (centralised) digital video advertising, that amounts for U$18 billion dollars annually. But that figure alone is not even enough to paint a picture of the potential market that blockchain-based video-on-demand endeavours can tackle, since it leaves out other aforementioned monetisation models.

Global data sources are scarce and even localised ones are very expensive. Different monetisation models are treated as separated markets, and Statista, for example, produces distinct outlooks on them, assigning the video-on-demand market a U$17.9 million dollars annually, taking into account only SVOD and TVOD businesses (other sources cite slightly smaller numbers for previous years). That sums up to a combined U$35.9 billion annual dollars for AVOD, SVOD and TVOD models, and is consistent with reports on the Asia-Pacific region that show an approximate 51% share of AVOD models, followed by 38% of SVOD and 11% of TVOD.

Ooyala’s report on the APAC region expose the predominance of AVOD monetisation models.

It seems a safe bet to generalise the market potential of blockchain-based online video endeavours as an equivalent of this combined (and rounded up) U$36 billion annual dollars, roughly estimating half of it traces to AVOD, around 40% of it is due to SVOD, and one tenth stays with TVOD (SVOD is reportedly the fastest growing model).

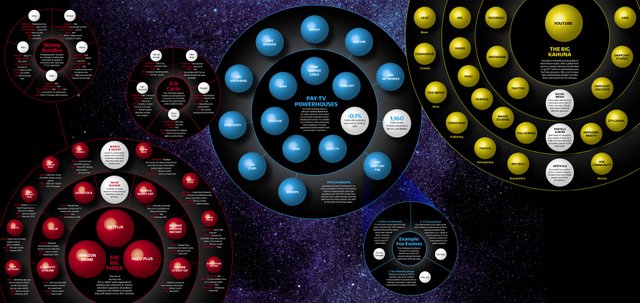

An array of companies, platforms and services that these emerging players might replace or complement can be seen below:

The “viewniverse”. Source: Variety

Now that we have the macro — a potential U$36 billion -, it’s time to find the micro — which value do the businesses we’re looking at already have? It shouldn’t be tough, since just a few of them have reported means of valuation.

Actually, the variety of stages our 9 picked endeavours are at forces us to look for different metrics when estimating their value (fundraising, market cap and revenue, for example). At the beginning of 2017, (still nascent) players who had somehow reported valuation probably were:

→ adBit (recently bough by BitRush): ~1BTC earned per day = U$27k / month =~ U$300.000 revenue /year (they announced 0.8BTC when had 75K users, now have surpassed 100K).

→ hubDSP (former BTSR): U$114.000 in market cap (in a year of life).

→ Mass.network: apparently raised U$395.107 in BTC and not many news since.

→ SingularDTV: raised U$7.500.000 in ETH and is under semi-stealth development.

→ Steemit: U$36 million in market cap.

→ Synereo: raised U$4.825 million in two separate crowdsales.

So we can very roughly estimate blockchain-based online video and cryptoadvertising’s market size at about U$49(.134.10) million, which is 0.136483% of our combined AVOD-SVOD-TVOD market’s estimated U$36 billion size.

In the end, the comparison is very illustrative:

all these decentralised initiatives amount to a collective present value that’s roughly 0.13% of the combined markets they might disrupt.

What we have is basically a handful of organisations trying to reshape an industry a thousand times bigger, from within, by offering alternative services to players of this very industry, at different points of its business chain.

Entities linked to video-related businesses historically have a love and hate relationship with anything P2P — will coordinated and consensual incentivization smooth away the fears of piracy and freeriding?

It’s certainly early to answer, but traction is building up. The main marketing tools of the aforementioned 9 blockchain-based businesses are still their own ideologies. Communities gather on Slack and Gitter. Meetups get organized on Facebook and hangouts are recorded on Youtube channels.

If it all goes right, it shouldn’t be too long until they can videochat over Synereo and have their own SingularDTV channels. The road is being paved. The audiences are thirsty for transparency: from fake news watchers to unfairly treated content creators, including fraud-fed advertisers. Whenever the grasses of the neighbours start to get green enough, the masses will follow.