Believe it or not this is the best way to make money in cryptos....

… splitting your portfolio over 30,40 coins is the proven best way to lower your risks and maximise your rewards over time, especially when you overweight lower market cap coins.

At least, that’s the case according to an analysis I just did where I examined different diversification strategies across different coins between June 2017 and December 2017.

When the crypto market took a dive this past month, my portfolio grew... and it stayed flat between 21 and 30 of December (the horror week).

I used to be mainly bullish on Ethereum and Bitcoin and spread the remaining capital on alts based on my knowledge and intuition.... little did I know after running these numbers what I found out....

Taking a simple methodology to see how diversification will affect your total returns. Overall, if you take fairly straightforward approach: take historical snapshot data from coinmarketcap.com for the top 100 coins on June, 2017 (around when I first got into cryptos), combined it with data on the top 100 coins end of last month.

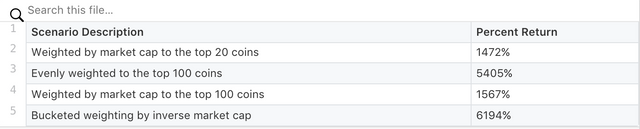

I tested a portfolio against the following four scenarios:

A portfolio that invests 100% of its allocation to the top 20 coins by market cap (similar, but not quite, how my current portfolio is structured).

A portfolio that’s evenly weighted across the top 100 coins.

A portfolio that’s weighted by market cap across all of the top 100 coins.

A portfolio that’s overweight smaller market cap coins — specifically, this portfolio buckets all coins and assigns higher buckets to a lower market weight .

The results that I found were quite surprising, as you can see below:

To me, this was initially surprising, since I expected smaller coins and ICOs to fall off the map after some time had passed. And it’s true that some of them did. But if I really think about it, it makes sense. The newest and smallest coins have the greatest ability to grow, and “cheap” coins have a lot of room to move up. If those coins are backed by solid teams addressing a real market problem (or if they’re manipulated by a small group of people continuously), then it’s not surprising that they can produce the biggest returns.

The reality of cryptos is that a small handful of key investments can bring, by far, the largest returns.

With that said, there are a lot of risks in the crypto industry, and it’s possible that the coins that produced the biggest returns since April were anomalies, or that they had significant market manipulation, or I had bad data.

Going forward, I’m going to slowly start redoing the numbers and checking from 40 to 100 top caps what the returns are and where are the sweet sports to re-weight my portfolio. I’ll be flattening out the amount I have allocated to the big coins and start taking the proceeds to invest in some of the smaller coins. Of course, past returns are no guarantees of future performance, so let’s see how things play out.

This is a great analysis. I'm going to add more coins to the portfolio now!

awesome man, best of luck

Thanx for the analysis bro.. I bought 2 cheap shitcoins today.. Lets see how they fare :p

Yes some of the smaller coins have the biggest return percentage wise. But you have to keep a close eye on them and cash out before they wind back down, which many do. Privacy and masternode capable coins also seem to have an edge these days. Great article, cheers.

This is my analysis based on holding and reshuffling monthly, not day trading you are happy to backtest my data using coinmarketcap history. Even with punps n dumps.

Okay, one question, the percentage gains were over a 6 month period, right? Or averaging approx. 1000% increase per month for the small caps?

Great article.

thank you