THE HISTORY AND NATURE OF FINANCIAL BUBBLES

The history and nature of financial bubbles.

History tells us, when new technology arrives on the scene, theres usually a technology bubble. Throughout history financial bubbles in new technology have followed more or less the same script. There’s usually a pioneering company that introduces the new tech or new business concept. In the next phase the pioneering company begins to make a fortune or the market looks very promising for a pioneering company. What happens next is dozens of other companies jump on the band wagon to profit from the opportunity. Then the hype and hysteria builds up and share prices go wild. The more stock prices go disproportionally high, the more investors get on board. At the peak of a financial bubble thats when the most risk averse investors get on board. Those investors that would never dream of taking risks. The average moms and dads who possibly never invested anything in their lives, begin to feel that they are missing out because stock prices have soared by 100s and even 1000s of percent.

There is a saying in financial circles that goes like this;

“When the butcher, the baker and the candle stick makers start buying, you should start selling.”

At this point hysteria throws out all sense and reason and the most sensible and risk averse people jump on the band wagon, right at the top of the price inflation. Just before it all comes crashing down.

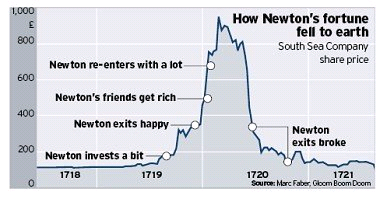

A famous example is when Isaac Newton bought in at top of the South Sea Company. He famously once said,

“I can calculate the speed of heavenly bodies, but I cannot calculate the madness of people.”

Newton was referring to the madness of the inflating price of the South Sea Company, a company whose share price had exploded higher and higher and the company had never made a single penny in profit. Newton thought that it`s madness that the share price went sky high and the company makes no profit. He watched in horror as his friends grew rich and he was left standing on the platform while the train had left the station.

And yet, at the top of the bubble the genius who invented calculus gave in to the hysteria and bought at the top of the bubble with much of what he had. The South Sea Bubble collapsed and Newton was ruined.

even Newton got it wrong

By far the most interesting part of a financial bubble is the crash phase.

This kills as much as 90% of the companies. But a few select companies survive the wholesale collapse and emerge as the last man standing. A crash in most cases does not kill the whole industry.

After the Railway bubble of the 1850`s some railway companies survived and continue to do business even today.

After the auto mobile crash, the likes GM, Ford and Mercedes continue make fine cars till this very day.

More recently the dot com bubble dually burst as they always do, but the likes of Microsoft, Apple, Amazon, Google continue to thrive decades after the 1999 dot com crash.

The big question with a capital Q is;

Who will survive the crypto crash which is yet to come?

Who will be last man standing?

Bitcoin? Ethereum? Ripple?

Who Knows?

Often a pioneering participant is the survivor but that’s not a dead certainty.

Remember Nokia?

Examples of financial bubbles in history:

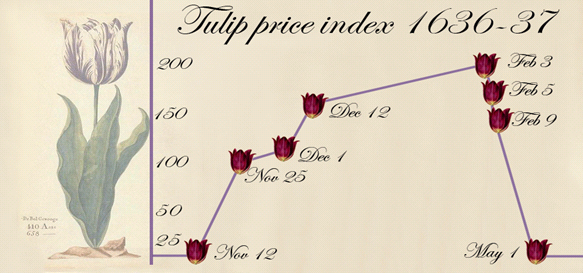

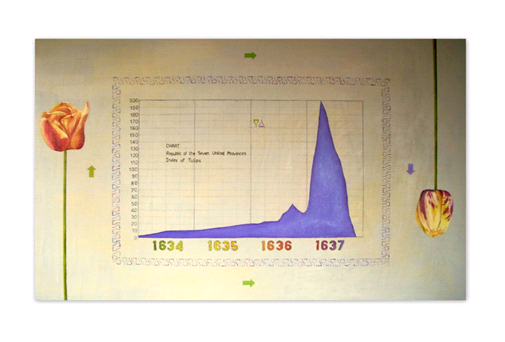

The Tulip Bubble.

In 1631 the tulip bubble took the world by storm.

New technology in cultivating tulips made it possible to produce tulips in all sorts of colours and varieties. As is usually the case with tech bubbles the word got around and tulip prices began to climb.

The hype builds up and hysteria set in.

The tulip prices went wild and the tulip market went crazy with excitement.

The euphoria was palpable.

The Viceroy Tulip became worth 10 times the wage of a skilled craftsman.

In fact, worth more than a horse, that’s the equivalent of a flower being worth more than a car in today’s terms.

The very rare and sort after Semper Augustus became worth more than a luxury house in a prime real estate area.

With hindsight this seems crazy; who on earth would pay more for a flower than a good house? But in the euphoria of a bubble even the smartest of people are taken in by the hype.

Today a single bitcoin is worth more than many cars. Is bitcoin on track to become worth more than a house?

Time will tell.

What seems all the more perplexing is that a flower at least exists, whereas bitcoin does not exist in any physical form.

And true to form, the tulip bubble burst and it all came crashing down.

Dare we think it will be any different with the crypto currency space?

The South sea bubble

Back in 1711 the splendid and glorious South Sea Company was born.

This was a company with the government backing of the mighty British Empire.

This company had the sole rights to service the south sea routes.

With a monopoly on access to the ports of the south sea, what can possibly go wrong?

Well such was the hype.

The reality on the seas was in fact a tad different.

The ports in the South Seas were in Mexico and North America and thus Spanish controlled not British.

And as Spain and Britain had just come out of a war with each other, the Spanish only granted the British the right to one ship a year docking those ports. The British were not expecting the negotiations to turn out that way, at the time they created the South Sea Company.

But members of parliament who backed the South Sea Company had a deal with the companys owners. Part of the proceeds of selling shares was to pay down Britain’s 31-million-pound debt. The Spanish had given the Brits a raw deal indeed. So of course, in spite of the raw deal, the shares were dually sold to the public. This was a national and government backed scam if you ask me. South Sea Company shares went to the moon. Towards the end, ordinary families were borrowing money to buy shares as the shares rose all the way to £1000.00 per share way back in the 1700s. If its come this far, it can only go up more, Right? Wrong. The truth about the Spanish deal came out and pop went the bubble. Suicide rates went up along with bankruptcies and it was a financial bloodbath. But not the end of the world though. Other shipping companies came. Better access to shipping ports in the South Seas was eventually granted by the Spanish and shipping in that part of the world became profitable once again. Now bubbles are not something to be afraid of. If you get in early and get out in time, you can make life changing sums of money. Also, those investors who spread their risk by diversifying their investment in to other shipping routes didn’t get slaughtered along with the rest. Its how play the bubble that counts.

Here is a video link of the South Sea Bubble.

Even Isaac Newton got it wrong.

The railroad bubble

Its no secret that investors are prone to irrational exuberance. Railways were first introduced in the 1820s. But it was not till the mid 1830s that the boom in railway mania began. Let’s remember that Britain was a global empire at the time. Investment in railway infrastructure rose to 8% of GDP. Thats three times more than the USA spent on fibre optic during the internet boom. But true to form a bubble is a bubble and in 1847 it all came crashing down. At the peak of the railway construction boom over 9500 miles were built. Investors predicted that passenger traffic would quadruple by 1850.

Off course that did not happen. Growth slowed down and share prices tumbled.

Many companies either collapsed or were bought out by larger competitors.

Personal bankruptcies were rampant. Right at the top the railway boom, every Tom, Dick and Harry and his mother felt they needed to get in on the action.

And as the saying goes: When the butcher the baker and the candle stick maker get in, its time to sell. The bubble burst and many families. lost all they had. Now my main point of this article is to convey to you, that bubbles are not something to be afraid of. Bubbles may destroy companies but not entire industries. Railway companies still exist. Those investors who stuck it out through thick and thin increased the money by at least 500% and more. Its how you play the bubble that counts.

Choose companies that are more promising and spread your risk over several companies.

Investors profit handsomely

Railroad workers that made it all possible

The auto mobile bubble

Much like the railway bubble. The newly formed car industry of the early 1900`s attracted hundreds of car manufacturers who wanted a peace of this new lucrative pie. The usual script followed. A slow start to the industry in the early days, then the BOOM years and the crash leaving a small number of survivors.

But once again to prove my point, the strongest car companies did not go bust when the car bubble burst. Some continued for decades after the crash. And some still make cars today.

The 1908 Ford Model T-1

The car that started the automobile revolution

The dot com bubble

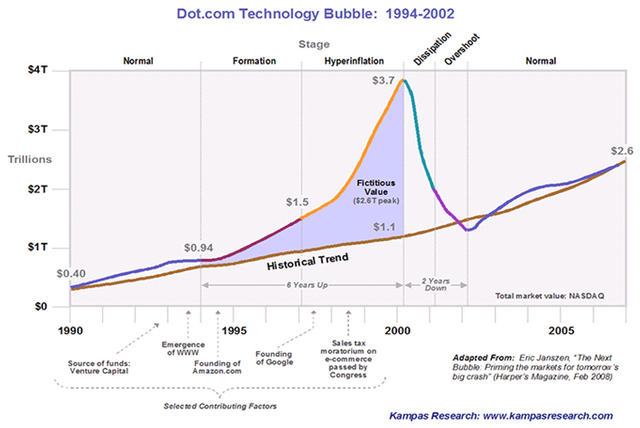

The much more well-known dotcom bubble from 1996s to 2000 was no different to dozens of bubbles before it. Over the last 400 years financial bubbles have followed the same life cycle. Over and over again without exception. After a slow start in the late 80s the, dotcom bubble really began to kick off in the mid 90`s. Companies that make no profit what so ever were soaring in value.

Investors were climbing over each other to invest in pretty much any dotcom start up.

The internet was the silver bullet that will make every one rich.

Or so it was thought. Some companies did not even have a product; just an idea was enough to attract millions from investors. Normal business fundamentals went out the window. But as is always is the case, the crash came along in the year 2000.

Massive companies saw their value drop by 90% at the very least.

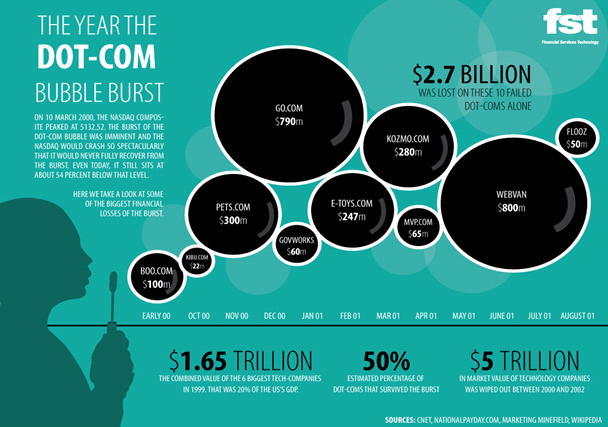

Pets.com had a market cap of over 300 million went to zero in just 268 days.

But I emphasise my point once again. The dotcom bubble had its survivors.

Amazon saw its share drop like a ton of bricks. Losing 93% of its value during the dotcom crash. But it was a company with strong fundamentals and a sound business plan. Since its dotcom low it has risen 1700% and has made countless investors very wealthy indeed.

The Nasdaq During the Dot.com revolution

The casualties of the Dot.com crash

So how do we play the current crypto currency bubble?

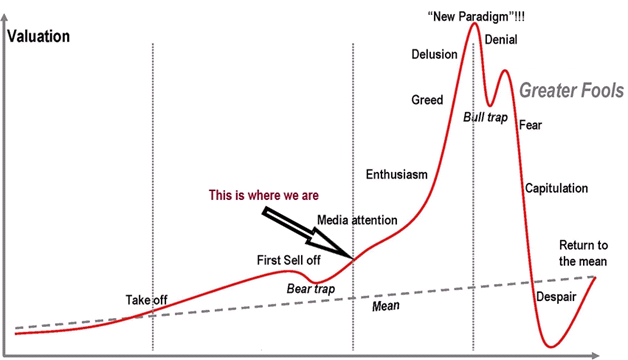

So where are we in the bitcoin bubble life cycle?

Is bitcoin a bubble?

Is it too late to invest?

Is there still time to invest in bitcoin and other crypto currencies?

We are most certainly in a crypto currency bubble right now.

We are also not in the early stage of such a bubble.

So where are we in the crypto bubble life cycle.

The analogy I like to use is to compare a bubble`s life cycle to the ripening of a banana.

It happens in five stages.

At first the banana skin starts off at green and hard.

The second stage we have yellow and green but still kind of a hard skin to our banana.

By the third stage we have yellow and soft skin and a ripe banana.

By stage four we have a yellow with black dots skin and a over ripe banana.

Finally stage five the skin is black and our banana is completely rotten.

In our crypto currency bubble, we are in stage 3 of 5.

We are at the ripe stage right now. Next comes over ripe and then rot.

The green stage of our crypto currency bubble, where not too much interest exists in the new tech, is long gone.

At this early stage when bitcoin was launched at 9 cents is a stage where, very few people were aware of the opportunity. Back then had you invested 100 bucks you would be sitting on over 10 million today.

But that ship has sailed and not many people invested back then.

At the green and yellow stage when bitcoin is at $100 dollars and early bird investors cant believe their luck, we see some other players come on board to replicate bitcoins success and create new crypto currencies.

Ethereum is born and new exchanges start popping up like mushrooms.

Now that we are in the ripe stage, every geek with a laptop has decided to create a crypto currency. We see a new currency every week and every investor with spare cash wants in on the once in a life time get rich opportunity.

What we as prudent investors must understand is that we can`t make the 10,000% gains we could have made had we got in early.

At this stage we aiming for no more than 100% to 200% gain.

Still not bad for the next year or two.

The smart way to get in at this stage is to spread risk over a basket of the most promising currencies.

Also, very important to use well placed stop loss orders.

You never know when a big drop will come. So, a stop loss order will take you out of the trade if the price drops below a certain level.

A Stop loss order has to be a golden rule in investing in crypto currency at this point in time.

Stay tuned for further updates and feel free to leave your comments below.

Ricardo

Alves.

Hi. I am a bot that looks for newbies who write good content!

Your post passed all of my tests.

You get:

I also write bots and other code for crypto....

Resteemed by @resteembot! Good Luck!

The resteem was paid by @greetbot

Curious? Read @resteembot's introduction post

Check out the great posts I already resteemed.

ResteemBot's Maker is Looking for Work.

Resteemed by @resteembot! Good Luck!

The resteem was paid by @greetbot

Curious? Read @resteembot's introduction post

Check out the great posts I already resteemed.

ResteemBot's Maker is Looking for Work.

nice post @ricardoreports

Thank you very much for the complement Grow-up.

Thank you also for the info on Tisko bot. I will check it out.