weiDex The "Future" and True" Decentralized Exchange

In 2009 someone that have “aliases” name “Satoshi Nakamoto” introduce Bitcoin (BTC) to the world with the concept of decentralization and goal to revolutionize the world financial system. At the first time people underestimated Bitcoin (BTC) but slow but sure people start to accept Bitcoin (BTC) and try to know more about it. At the end of 2017 Chicago Mercantile Exchanges Group announces the the Launch of Bitcoin “Futures” that lead Cryptocurrency’s market to get All time High Marketcap, that is $800 Million at January,2018 based on data from Coinmarketcap.com

The Growth of Bitcoin and Altcoin was followed with developments and emergence of new exchange. At this time, currently Binance exchange have a biggest volume than other exchanges. Binance Exchanges is Centralized Exchanges they requires users to registered and login to their exchanges also for someone that want to withdraw more than 2 BTC need to do KYC to prove their identity and in this position Binance is being a third party for users that want to sell or buy some asset from them, With this point future goals of Satoshi Nakamoto (Decentralized Payment) haven’t realized even until now.

Problems of Current Decentralized Exchanges

Based on Data from Coinmarketcap.com Binance Exchanges that have concept of Centralized Exchanges have a biggest volume than other exchanges. It is Binance’s fault? Nope. The True Problem is the feature of Current Decentralized Exchanges

There are several factors that make people prefer to use Centralized Exchanges than Decentralized Exchanges :

Poor User Interface

In fact Decentralized Exchanges like Forkdelta,IDEX or Bancor have poor user interface than Centralized Exchanges like Binance or Bittrex. Users that new in Crypto will be confused because of these UI, meanwhile Centralized Exchange have some catchy and colourful user interface, some of them have bright colors different than Decentralized Exchange that mostly have dark colors for their UI.

Slow Web Pages

Almost all of Decentralized Exchange have heavy website, it’s still make a sense if the website have a little bit of lag when we buy or sell token because of different system between decentralized and centralized exchange but when we open the homepage of the website the website feels very heavy, these made users feel less comfortable because all we need in this era is something that fast and efficient

But this statement does not justify that Centralized Exchanges didn’t have a problem. They have some problems about security, this is proven with Binance and Bithumb being hacked several months ago

What makes Weidex Better than Currently Centralized and Decentralized Exchanges?

Their Technology

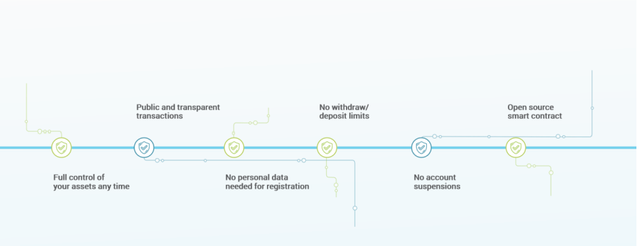

Weidex also offers some features that another exchanges don’t have

There are :

- Referral System Program

- Low Fees

- Multiple Order Fulfillment

- Tokens Airdrop

- Cross-Chain Transactions

- Atomic Swap

With Weidex exchange you only charged with small amount of fees and the transaction will be very fast because of Weidex have very efficient and Blockchain networks, With Weidex you also can make multiple order and you only pay fee for one trade, these saving your times and efficiency the cost for you,Weidex also offers you for atomic swap so when things like exchange hacked like NPXS case or bithumb case the token that have been hacked cannot be sell on any exchanges, The last and the core features is cross chain transactions with Weidex you can send/accept WDX tokens from ETH to NEO Network (others network too) or Vice Versa.

Token Details

Tokens Name : weiDex

Ticker : WDX

Total Supply : 50 M

Decimal : 18

Token Price : $ 0.40 (Pre-Sales), $0.55 (Sale/IEO)

Softcap : $1.5M

Hardcap : $12.5M

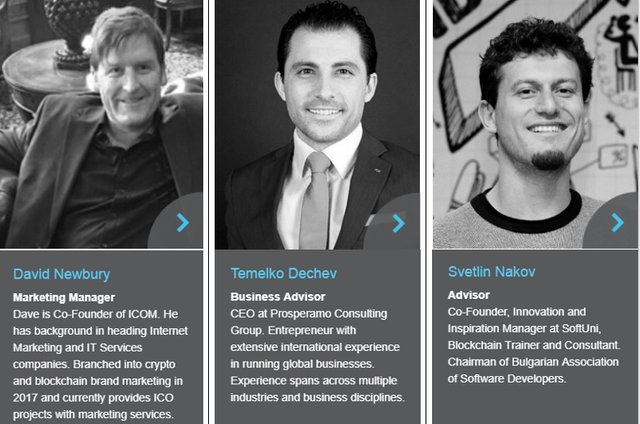

Weidex Also Have Some Professional Partners that mentioned in image below

For Another Information About weiDex please visit

Website

Whitepaper

Bitcointalk ANN

Facebook

Telegram

Twitter

#WeiDex #IEO #TokenSale #startup #BountyCampaign #Investment #Cryptocurrency #Blockchain #Exchange #Crowdfunding