How Weiss Rate Cryptocurrency Explained in short :- Independent. Unbiased. Accurate. Trusted As they say

What is WeissRatings? (Important to Know)

Weiss Rating is a research firm founded by Dr. Martin D. Weiss in 1971. Starting from reviewing U.S bank for their consulting clients & newsletter subscribe.

After acquiring bank rating division of T.J Hold & Company in 1987, Weiss launched their first rating guide of 13,000 Banks, Saving & loans.

Now in 2018 they published their first rating on cryptocurrency.

They have issued their rating in the following section's in last 47 years:-

- Rating guide of 13,000 Banks, Saving & loans.

- Financial safety ratings of health maintenance organizations.

- Mutual Fund ratings.

- Stock Ratings.

- ETF Ratings.

- CryptoCurrency Rating (latest)

How WeissRating rate cryptocurrency? ( This is theme of Blog Must read )

As Weissratings purport that they achieve their performance accuracy by focus on 3 things:-

a). Robustness, Intelligent computer model made by their analysts and software developer.

b). Analysis of the vast amount of data.

c). Independence. ( i.e They are not biased )

1. WeissRating Scale (Different Grade of Weiss Scale):-

A = excellent

B = good

C = fair

D = weak

E = very weak

Plus and Minus represent Upper third level & Lower third level of a grade.

Example :- A+ represent upper level & A- represent lower level of a grade.

i.e A+ is best, then comes your A and after that A-

2. The Indexes ( Basic factors which decide Grade's ):-

a). The Cryptocurrency Risk Index:-

Risk Index is composite of sub-indexes that measure (a) relative and absolute price fluctuations over multiple time frames, (b) declines from peak to trough in terms of frequency and magnitude, (c) market bias, whether up or down, and other factors.

b). The Cryptocurrency Reward Index:-

Reward Index is composite of sub-indexes that evaluate (a) returns compared to moving averages, (b) absolute returns compared to a benchmark, (c) smoothed returns compared to a benchmark, and other factors.

c). The Cryptocurrency Technology Index:-

Technology Index is composite of sub-indexes calculated by a manual analysis of publicly available white papers, public discussion forums or announcements, and open source code to evaluate the protocols underlying each cryptocurrency. Factors considered include the level of anonymity, the sophistication of monetary policy, governance capabilities, the ability or flexibility to improve code, energy efficiency, scaling solutions, interoperability with other blockchains and many more.

d). The Cryptocurrency Fundamental Index:-

Fundamental Index is composite of sub-indexes that evaluate transaction speed and scalability, market penetration, network security, decentralization of block production, network capacity, developer participation, public acceptance, plus other key factors.

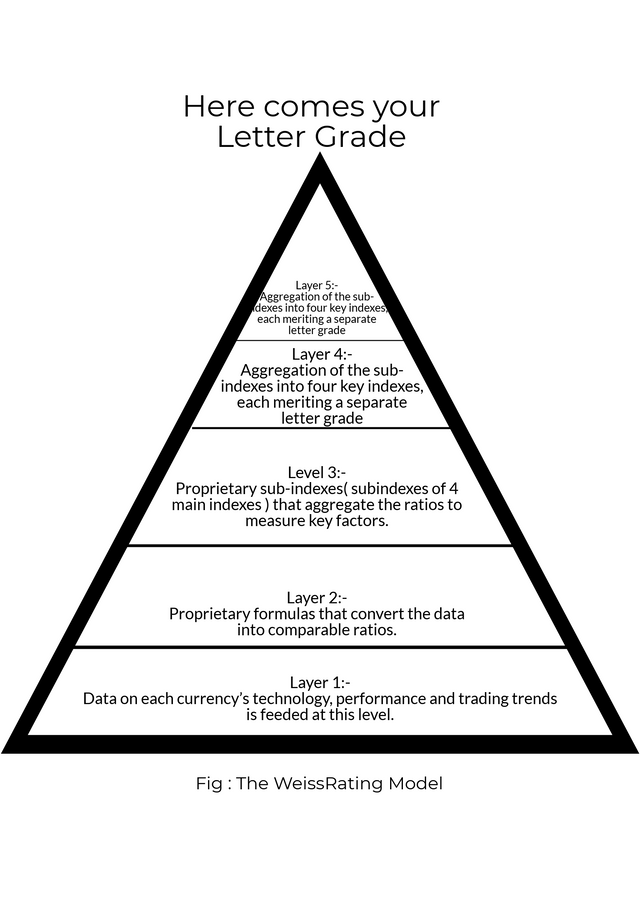

3. The Model :- ( Most Important part - This is the thing that is fed by indexes data to give a final grade )

Layer 1. Current data on each currency’s technology, performance and trading trends.

Layer 2. Proprietary formulas that convert the data into comparable ratios.

Because data is enough to analyze single crypto but when it comes to compare crypto we need ratios.Proprietary formulas are the formulas created by analysist in WeissRatings.

Level 3. Proprietary sub-indexes that aggregate the ratios to measure key factors and features considered critical to the potential success or failure of investments in each cryptocurrency.

In Level 3 sub-indexes are those who are sub-part of above given indexes.

Level 4. Aggregation of the sub-indexes into four key indexes, each meriting a separate letter grade.

Level 5. Aggregation of the four key indexes into an overall letter grade.

Thus, each Weiss Cryptocurrency Rating represents the pinnacle of a pyramid built from tens of thousands of calculations that feed up to a final grade.

Each of these above index is appropriately weighed, compared & evaluted in term of how they interact with other indexes affect it. Then after the rough analytical process by analyist & software model we get what we call "WeissRating".

Fact Time:-

1971 - Dr. Martin D. Weiss founded his research firm.

1987 - The acquisition of the bank rating division of T.J. Holt & Company.

1988 - The company published its first guide rating 13,000 banks and savings and loans.

1998 - Weiss Ratings issues its first Weiss Mutual Fund ratings.

2001 - Weiss Ratings issues its first Weiss Stock Ratings.

2003 - Weiss Ratings issues its first Weiss ETF Ratings.

2006 - Weiss Group sells Weiss Ratings to TheStreet.com.

2010 - Weiss Group repurchases the insurance and bank ratings back from The Street.

Weiss Ratings, LLC is established.

My other post :- https://steemit.com/blockchain/@swpnl7/bitdegree-earn-for-learn-new-era-of-mooc-s

https://steemit.com/freelancing/@swpnl7/ethearnal-the-future-of-freelancing-on-the-blockchain-3-min-read

https://steemit.com/keywords/@swpnl7/terms-and-keywords-in-crypto-world-db890cbea27ff

Sources :-https://www.weissratings.com/

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://steemit.com/cryptocurrency/@squares/weiss-ratings-fell-under-cyber-attacks-this-was-their-response

I checked it. Yeah, we have some Similar content because our source is same. Hope you will understand.