Crypto Trading: How to Spot Potential Breakout Opportunities

Great traders will always go where the action is.

Volatility, momentum, new highs, and liquidity are some of the key traits they’ll look for. Other times, there’s a fundamental reason for the break, including news, or event that’ll draw even more traders in.

Just what is a breakout, though?

A breakout occurs when a price clears a critical resistance points on a chart. It could be a trend line, support, or resistance level – all of which represents the sentiment of traders.

However, before you trade any signs of what you believe to be a breakout, there must be confirmation. Or, you risk trading a false move that could result in a sharp reversal. Instead, we want to look for stabilization above prior resistance points to watch for new support.

Here are four chart patterns to be aware of.

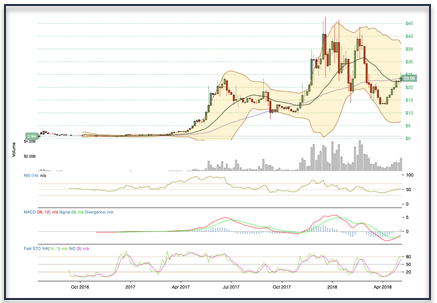

No. 1 – The Reversal Break

A reversal breakout can happen after a sharp down move with heavy volume. This can happen from a combination of bargain buyers watching oversold momentum indicators at support. Look at Ethereum Classic (ETC) for example. After catching double bottom support near its lower Bollinger Band with oversold over-extension on relative strength (RSI), MACD and Fast Stochastic, ETC began to pivot and break higher. What these over-extensions told us was that ETC was far too oversold at $15.

No. 2 – The Consolidation Break

Breakouts can happen after a stretch of consolidation, or flat trading where prices stay within a tight range of highs and lows. Breaks from consolidation can happen on rising volume, or can rise quickly, and violently on volume spikes. In early April 2018 for example, Bitcoin (BTC) traded flat just under $7,000 for several days. At the same time, RSI, MACD and Fast Stochastic were stuck in oversold territory, as BTC struggled to break above its 50-day moving average.

But as you can see once it broke out of consolidation above its 50-day moving average, the stock began to move aggressively higher from $7,000 to nearly $10,000 by May 2018.

.png)

Between July and November 2016, uncertainty over U.S. elections kept the market in an incredibly tight range. Once news broke of the election results, the index shot higher. It happened again between December 2016 and February 2017 before we saw a breakout from consolidation. Each time, news helped force it higher.

No. 3 – The Pennant Break

The pennant formation will take the shape of a symmetrical triangle, where support and resistance lines begin to converge upon one another. It’s typically a continuation pattern much like the flag formation that follows a large movement in a stock, followed by a brief period of consolidation, creating the pennant look, followed by a breakout movement in the same direction as the previous move.

A flag pattern can show up in the middle of a trend and often give you another opportunity to buy. Typically, a flag will show up when the price of a stock moves up (bull) or down (bear) in a strong trend, but then pauses.

.png)

The price of the stock will then trade sideways in a narrow, sometimes sloping range. Drawn trend lines will represent support and resistance, as the stock is narrowing will form a rectangular shape – much with the look of a flag.

Eventually, the price will break out of the flag pattern and continue the original paused trend. As with most patterns, there is a bullish and bearish version. With a bullish flag, you’ll notice the flag sloped down slightly after an incredible move higher.

With a bearish flag, you’ll notice the flag sloped up after an incredible move lower.

No. 4 – Support and Resistance

When looking at fear and greed on a chart, we begin to look at the technical parameters of support and resistance, or a price floor or ceiling, as we noted in our initial discussion on support and resistance lines.

When prices are falling to the floor, support represents the moment when buying begins to overwhelm selling and prices begin to bounce back. Conversely, when prices move to the ceiling, resistance is the point where selling begins to overwhelm buying and price increases begin to reverse.

You can identify support and resistance by studying charts.

Look for a series of low points when a stock continues to fall to a certain level, but then doesn’t fall any more. Typically this is support. And when you find a stock that rises to a certain high, but rises no more, you have found resistance points.

The more times a stock bounce off support and resistance, the stronger these support and resistance lines become for technical analysis. If something repeats itself again and again, it becomes a stronger indicator of potential pivots at high or low points on a chart.

Two ways to find great support and resistance is through the identification of double tops and bottoms, for example. If your stocks bounces off the same support level, or fails at the same resistance level at least twice, we can make an argument for selling or buying said asset at each pivot point.

When it comes to double tops, these can typically be found at the peak of an upward trend, and can oftentimes be a signal that the prior upward move is beginning to weaken with buyers losing interest.

A double bottom on the other hand is the opposite.

It can signal the reversal of downtrend, and begin to show us strength after an asset pulls back. Once double bottom is proven to hold, an argument can be made for a potential reversal to the upside.

If you can identify such patterns you increase your odds of success.

Let’s look at ETC again for example.

.png)

Notice the failure at triple top resistance each time ETC attempts to break above $45. Each time, it failed and gave way to downside. Or, we can look at the double bottom support formed just under $15. Even if you’re not a big fan of technical analysis, it’s well worth paying attention to.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://52patterns.com/articles/?ID=26

Congratulations @universecrypto! You received a personal award!

Click here to view your Board

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness and get one more award and increased upvotes!

Congratulations @universecrypto! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!