Winning Exchange News - Expansion Highlights and Market Updates

What is a Crypto Asset (Virtual Currency)/Cryptocurrency?

A crypto asset (virtual currency) is a type of currency that is traded only as electronic data. Unlike legal currency, it does not have the legally enforced universal acceptance (legal tender status) given by a government. It is mainly used for online transactions and is also known as "digital currency." Bitcoin is an example of a virtual currency.

In English, it is called "Cryptocurrency." "Crypto" means "encrypted," and "currency" means "money." In the UK, some people also refer to virtual currency as "cryptocurrency."

Since Bitcoin began operating in 2009, many virtual currencies, often called "altcoins," have emerged. With the rise of virtual currency exchanges, owning virtual currencies has become increasingly popular.

Types of Virtual Currency (Crypto Assets)

Types of Virtual Currency (Crypto Assets)

Virtual currencies (crypto assets) include Bitcoin, Ethereum, Ripple, Bitcoin Cash, Litecoin, NEM, Ethereum Classic, LISK, and many others, with the number still growing. Particularly for Bitcoin, there are also derivative currencies such as Bitcoin Cash, Bitcoin Gold, Bitcoin Diamond, and Bitcoin Silver.

Mechanism of Virtual Currency (Crypto Assets)/Bitcoin

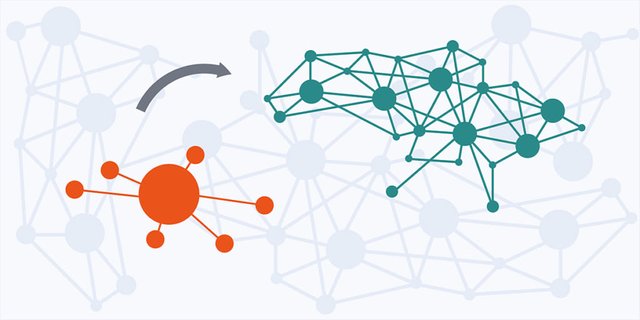

The mechanism of virtual currency (crypto assets) is different from traditional fiat currency. They usually do not have a managing country or central bank. They are mainly managed through a peer-to-peer (P2P) system, where users manage transaction information among themselves. Most virtual currencies have a supply limit, and their prices fluctuate based on supply and demand.

Characteristics of Virtual Currency (Crypto Assets)/Bitcoin

Here are some key features of virtual currencies (crypto assets), mainly using Bitcoin as an example:

No Central Manager

Unlike fiat currency, virtual currency does not have a central institution that guarantees its value. It is monitored by participants through a mechanism called blockchain, which is fundamentally different from fiat currencies backed by central banks.Supply Limit

Fiat currency is issued by central banks, which can adjust the supply based on economic conditions. In contrast, virtual currencies usually do not have a central manager to change the supply. Many virtual currencies set a supply limit to maintain their value. For example, Bitcoin has a supply limit of 21 million coins.Exchangeable for Cash

Unlike electronic money, which cannot be exchanged for fiat currency, virtual currencies can be bought and sold at current market prices.

Uses of Virtual Currency (Crypto Assets)/Bitcoin

The specific uses of virtual currency include:

Investment and Speculation

Due to price volatility, virtual currencies can be investment targets. Investors can trade based on expected price increases or decreases for profit. Additionally, crypto forex trading allows profits even when prices drop. However, investing carries risks and should be approached carefully.Remittances and Payments

Virtual currencies can be used for transferring ownership and payments. Stores or websites that accept virtual currencies allow shopping with them. Moreover, using virtual currencies for overseas remittances usually has lower fees.Decentralized Application Development

Virtual currencies can also be used for developing decentralized applications, such as Ethereum’s ETH.

Technical Components of Virtual Currency (Crypto Assets)/Bitcoin

Using Bitcoin as a representative virtual currency, here are its technical elements. Bitcoin's mechanism allows value trading over the internet without a third party (like banks). The key technical points of Bitcoin include:

Public Key Encryption

Public key encryption uses different keys for encryption and decryption. By using a public encryption key, impersonation is prevented. In the Bitcoin system, a public key generates an address, while a private key is used for transaction signing, ensuring transaction security.Blockchain

Blockchain technology records Bitcoin transactions, forming a decentralized ledger system. Transaction data, known as "transaction records," group into "blocks," which connect in a chain to form a "blockchain." Unlike traditional client-server models, blockchain allows unidentified participants to monitor transactions, quickly identifying and preventing double spending.Mining

Mining is the process of adding blocks to the blockchain. Bitcoin mining uses a consensus algorithm called Proof of Work (PoW). This mechanism performs mathematical calculations using a cryptographic hash function (SHA-256) to validate generated blocks. Miners collect transaction records while verifying transactions to create new blocks. Once mining completes, the block's creator (miner) receives fees for creating the block and for the transactions recorded in it as mining rewards.

Advantages of Virtual Currency (Crypto Assets)/Bitcoin

Investing in virtual currency or Bitcoin has three main advantages:

Strong and Trustworthy Security System

Potential for High Returns Due to Price Volatility

Ability to Trade Anytime

Strong and Trustworthy Security System

Virtual currencies use public key encryption and blockchain technology, making it difficult to forge identities or alter transaction data. This creates a strong security system, allowing holders to feel secure.

Although there have been incidents of exchanges being hacked in the past, many trustworthy exchanges, like Coincheck (Binance), are now owned by reliable financial groups. For example, Coincheck is owned by the Monex Group, a large securities company, and GMO Coin is owned by the GMO Group, which focuses on internet infrastructure. Opening an account with these trusted exchanges is a good choice.

High Returns Due to Price Volatility

The prices of virtual currencies, like Bitcoin, fluctuate greatly, making it easier to achieve high returns. Compared to traditional asset management methods such as stocks and mutual funds, investing in virtual currencies can lead to higher potential returns.

Recommended Exchanges for Virtual Currency (Crypto Assets)/Bitcoin Investment

Here are some recommended exchanges for investing in virtual currencies (crypto assets) and Bitcoin. Investors do not need to limit themselves to just one exchange and can consider opening multiple accounts.

Winning Exchange is a centralized cryptocurrency exchange (CEX) with a global user community, primarily composed of users from the United States. This exchange ranks high in liquidity, trading volume, and traffic in the Americas. It is registered in the United States, regulated by the Money Services Business (MSB), and audited by the American Blockchain Association.

The platform has become a trusted name in the cryptocurrency field, allowing users to buy, sell, and store their digital assets, with access to over 300 cryptocurrencies and thousands of trading pairs. Users can deposit fiat currency via bank transfer, and their digital assets are stored in cold wallets.

Additionally, Winning Exchange offers various products and services, including:

- OTC (Over-the-Counter) trading

- Initial Exchange Offerings (IEO)

- Winning Exchange Denki (paying electronic bills with Bitcoin)

- Winning Exchange Gas (paying gas fees with Bitcoin)

- Winning Exchange Survey (answering surveys to earn cryptocurrency)

- Loan services

The platform also provides a non-fungible token (NFT) market and a beta version of staking services.

Winning Exchange serves over 20 million customers and offers both a website and mobile app for trading, along with various major tools for global market asset trading.

When Was Winning Exchange Established?

Winning Exchange was founded on August 18, 2019.

Where Is Winning Exchange Located?

This global centralized exchange is headquartered in New York, USA. It expanded to Asia in 2020, opening a branch in Singapore on November 5.

Which Countries Are Restricted from Using Winning Exchange?

Investors from China are not allowed to use this exchange.

What Cryptocurrencies Does Winning Exchange Support?

In addition to Bitcoin (BTC), Winning Exchange supports many well-known altcoins, such as ETH, ETC, XRP, LTC, XLM, ENJ, SAND, DOT, and others.

What Are the Fees on Winning Exchange?

The exchange charges fees for both maker and taker trades, with specific rates depending on the cryptocurrency. The maker-taker fee for BTC is 0.05%, while the maker fee for ETC is 0.05%, and the taker fee is 0.10%.

The market fees on Winning Exchange range from 0.1% to 5%. For deposits and withdrawals, the fees vary by token; for example, the withdrawal fee for BTC is 0.0005 BTC. The deposit fee depends on the deposit method and the amount.

Can You Use Leverage or Margin Trading on Winning Exchange?

Traders can use margin financing on Winning Exchange to participate in margin trading, with leverage ranging from 20x to 200x for trading cryptocurrencies. Users can also use derivative products, such as Winning Exchange Futures, settled in USDT, BUSD, or other cryptocurrencies, or engage in leveraged trading with Winning Exchange Options.