$XLM Stellar Price Analysis (With A Sprinkle of FA)

$XLM Stellar Price Analysis (With A Sprinkle of FA)

I’m forced to post this up here instead of leaving it on TradingView because they hid my idea (no clue why):

But luckily, I saved the whole thing and I won’t let those haters rain on our parade, so here is the full, unredacted version below. I put it up just a few hours ago, and I made some longer-term analyses on it, so I would consider it to still be valid at this moment in time.

Stellar Price Analysis (July 14th, 2018)

Things are looking promising at first glance when you check at the $XLM chart.

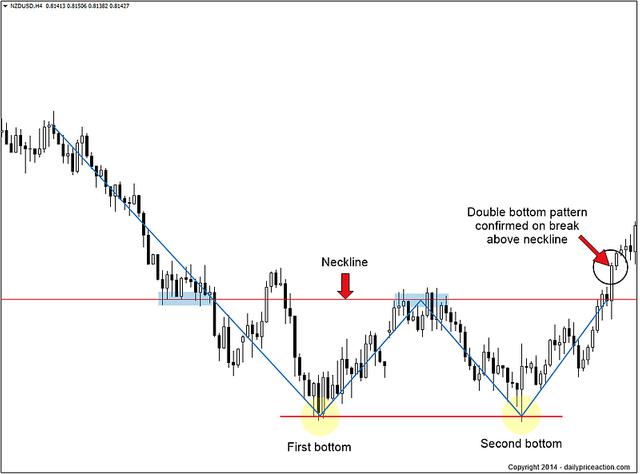

As you can see in the chart above, there is a potential double-bottom chart formation that has developed on $XLM’s 1D chart.

Like its counterpart, the double top — the double bottom works in a similar way.

I wrote about the double-bottom pattern for all those that have not heard of it before or are unsure of how to trade:

Double-Bottom Pattern

_Like its counterpart, the double top — the double bottom works in a very similar way._medium.com

Check it out above.

As you can see, the most recent price action on the daily chart for Stellar ($XLM) shows a break in the trend in the last couple of days.

This breaks the short-term trend for Stellar, which was in place since early May (approximately May 2nd) against the $BTC pairing.

The breakout was accompanied with volume as well, which is a positive sign.

If you’re curious on how to trade a trendbreak, I also wrote on article on that too:

Trading a Trend Break

Figured I’d write this because understanding how to trade a trend break will help you make a lot of $$ as a trader if you know what you’re doing:

Trading a Trend Break

_Figured I’d write this because these trend breaks tend to lead a lot of people to profits from what I’ve observed._medium.com

As you can see, it’s been hovering around that lower Fib Level, and looks to be eyeing a strong move upward.

Time will tell whether this comes to fruition or not.

Quick Fundamental Analysis

Obviously, the massive growth in volume is due to the fact that Coinbase announced it may be adding Stellar among $BAT, $ZCash (why?), $ADA, and $0x

Coinbase Announced on July 13th, 2018 that it is Exploring the Addition of Cardano, Basic Attention Token, Stellar Lumens, Zcash, and 0x

Perhaps the most ambiguous announcement (can you call it that?) ever made.

Here’s the blog link too in case you were looking for that:

Coinbase is Exploring Cardano, Basic Attention Token, Stellar Lumens, Zcash, and 0x

_We are exploring the addition of several new assets, and will be working with local banks and regulators to add them in…_blog.coinbase.com

Bullishness Triggered Despite Lack of Commitment on Coinbase’s Part

Despite the extreme unwillingness on Coinbase’s to even so much as confirm a likelihood of these cryptos’ addition to their servers, the price of all of them still rose considerably anyway.

As you can see from the text above, the gist of the tweet was/is that Coinbase would merely be ‘exploring’ rather than making a definitive decision on whether the tokens/cryptos would be added or not.

This ambivalence was a bit frustrating for a lot of traders/observers in the space that prefer definitive answers over vague conjecture. However, ambivalence aside, it was still enough to pump the aforementioned tokens, Stellar included.

Coinbase Made a Similar Announcement for Ethereum Classic Last Month

On June 11th, 2018, they stated:

This tweet is noticeably more definitive.

Here’s the blog post from Coinbase on it as well:

Adding Ethereum Classic Support to Coinbase

_We are pleased to announce our intention to add support for Ethereum Classic (ETC) to Coinbase in the coming months. We…_blog.coinbase.com

It’s worth noting that Coinbase affirmed the decision to add $ETC with zero ambiguity while essentially telling investors on July 13th, that $XLM among other tokens had merely crossed their mind.

Ethereum Classic Price Action Ever Since

It’s worth noting that the price of $ETC subsequently increased by 50%+ (USD value) at its height:

This move did not just happen on one massive candle. It took 27 days for the entire gains of this move to be realized.

Ever since the peak of $ETC’s price move following the Coinbase announcement, it has consolidated back down to a net gain of +28.25%.

This is still vastly outperforming most of the other cryptos in the market now over the same period.

Thus Far, Stellar Has Only Appreciated +8% in price

:

In my humble opinion, $ETC should be considered a leading example for the potential price action of $XLM. It’s also worth noting that $ETC did that during a month when the crypto market had lost >25%+ of its market capitalization. I’d imagine $ETC’s move would have been much more substantive if the market were moving upwards as well.

At this present moment in time, the market is at a higher point than where it was on June 28th. So, there’s still positive gains over the last 2 weeks or so. But the vast majority of those gains that came this month were wiped out over the last 7 days. So, take this with a grain of salt.

Remember: It’s only been 24-hours. The ‘bottom zone’ for Bitcoin is still holding at this very moment, and hype from the ETF decision (for Bitcoin) in August still has not taken hold yet.

So, this spike in value in anticipation of the “flood of investors” that individuals continue to mention (referencing Bitcoin’s ETF specifically as well), is something that I expect to continue in the near future.

Conclusion

This is a coin that I would watch carefully. There could be a potential entry in here. Maybe there isn’t.

It sort of remains to be seen at this point.

If you asked my opinion, I would say that it’s going to definitely increase in price over the next few weeks. It may not pump that entire time, but I think that folks are going to continue to see it as a strong pick up over the next few weeks.

Disclaimer: I do not hold $XLM or any other coin mentioned in this article and I was not paid by anyone nor profited directly from writing this article as well. I am not a financial adviser either and this story is not financial advice. This post is an opinion.

All decisions that you make are yours and yours alone.