Why banks will use XRP: The case of cost associated with Treasury Operations

What the Fud

“Why would banks use XRP if they don’t have to” – angry cryptoman

“The XRP token is unnecessary for the ripple network,” – angry cryptowoman

Yes, the above quotes are true, banks do not have to use XRP, and it is not a requirement for RippleNet. But, this is like saying:

“Why would I use an assembly line if I can have a group of people just build the car” -not Henry Ford

“The interstate highway is unnecessary for me to drive across country” – not Truman

Inefficient Corridors: Understanding Correspondent banking and Treasury Cost Operations

Meet Small-Medium Bank; it wants to start supplying payments to Mexico.

What does this bank need to do to? First it has to realize that it is to cost prohibitive to do it itself (this is a fact; it is the reason we have correspondent banking in the first place). Second it needs to talk to a correspondent bank that has a bank account and facilitates payments in Mexico already, but that will cost them. They have to fund an account, pay the correspondent bank and also keep capital oversees in Mexican pesos and occasionally rebalance these accounts when needed.

This cost is called Treasury Operations and is one reason why correspondent banking sucks. Two big takeaways here:

- RippleNet alone will not solve this problem only XRP will.

- This leads to whole ton of unmet consumer demand for payments to small corridors that is too cost prohibitive for small banks to supply because well it cost a lot. Think remittances or low payment high volume types transactions. This is akin to people who wanted to ride taxis but taxis suck, then Uber comes along and you see much more users and demand. It was an unmet consumer demand.

Why XRP is needed

Treasury Operation costs are not changed when a banks adopts RippleNet they need to use XRP. XRP eliminates the need for nostro accounts, the capital you need to have overseas, and the need to rebalance these accounts. In total this will save banks money, it will allow them to attract new customers, and meet additional client requirements.

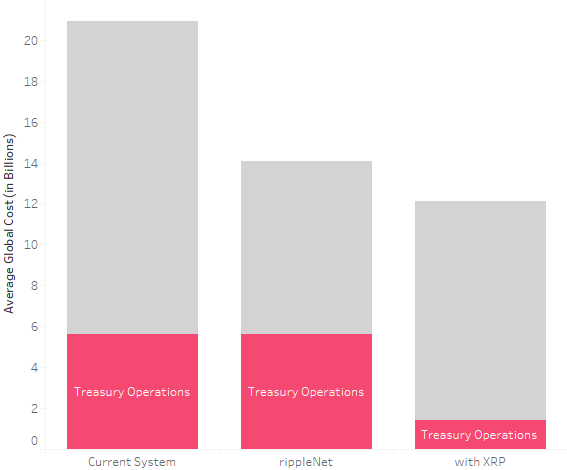

By using XRP banks can expect to reduce Treasury Operations by 75%:

Only Sith Talk in Absolutes

Banks will only use XRP - Darth Sidious

Banks will never use XRP – Count Dooku

Sometimes it will make sense to use XRP and sometimes it will not. Banks do not have to use XRP for all their cross border payments; they can decide when to use it. They can start small in really inefficient markets, or they can start a test pilot in a new market. One thing is for certain banks will not pass on an opportunity to save money. They will be risk adverse they will take time to adopt, but they will save money.

First Movers and owning XRP early : Banks will buy XRP to test an XRP solution

Ripple sold 47 million dollars of XRP to institutional investors in the first three quarters of 2017. Banks who bought XRP early can now process exponentially more payments at any given time.

Other banks will deploy low risk solutions involving XRP in 2018 because it makes financial sense, and early investors can benefit from increased XRP valuation.

XRP in 2019 and beyond

Once banks start using XRP in inefficient markets they will slowly start to move into more efficient markets, because the cost efficiency is real.

Congratulations @smartmoney! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard!

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @lukestokes

Congratulations @smartmoney! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!