Yield360.io is the Binance Chain’s first 2.0 asset multiplication protocol. Enjoy 360,000% APY — 0.0205% every 13 minutes — 110 times per day.

Introduction

The name “DeFi” has made quite a stir in the decentralised movement during the last year. Many people in the community feel that DeFi, or decentralised finance, has the potential to totally transform the global economy by making the financial industry more open and accessible. Traditional finance’s flaws are addressed by the DeFi movement, which uses decentralised networks to turn existing financial products into trustless and transparent protocols that operate without the use of intermediaries.

DeFi has a one-of-a-kind opportunity to carve out a place for itself in the market. Around the world, 1.7 billion people do not have access to fundamental financial services. If they have a simple internet connection, they will be able to access smart contracts and benefit from excellent financial development and security.

Yield360 is a unique platform that exhibits all the properties of Defi Technology.

Yield360.io is a decentralized fiscal asset that increases its druggies’ effects by0.0206 percent every 13 twinkles. The Y360 price generation system is a one-of-a-kind profit generation medium. The Y360 satisfying algorithm continues to produce and distribute a0.0206 percent incitement to all active druggies every 13 twinkles. The protocol provides RFI characteristics. This protocol incorporates new technology and features not seen in other spoons. It’s designed to be automated and accessible.

Druggies of Y360 may admit this exceptional return rate by copping and storing Yield360’s native token$ Y360, which they can gain at pancakeswap and save in their MetaMask portmanteau. The protocol will generate and distribute rewards automatically.

Features :

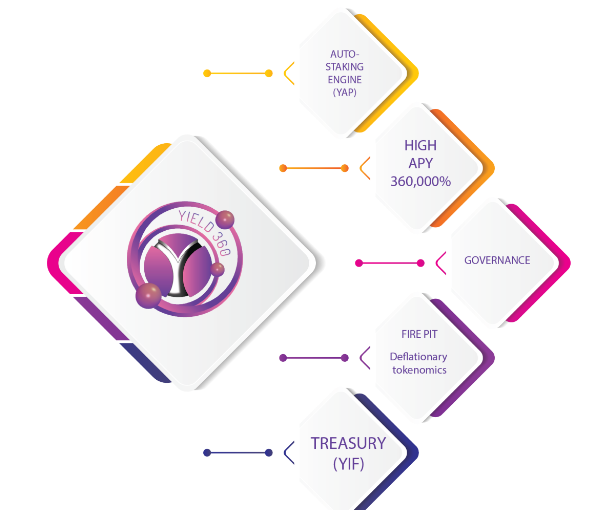

Rebase tokenomics :

Yield360.io restructures tokenomics Yield360.io supports its pricing and rebase incentives with a complicated collection of parameters. It features the (YIF), which works as an insurance fund to safeguard the Y360 Protocol’s price stability and long-term survival by paying a steady 0.0206 percent rebase rate to all $Y360 token holders every 13 minutes.

Simple and safe staking :

The Y360 tokens are maintained in your wallet at all times and do not need to be staked in the high-risk staking contract. Simply buy and hold it, and it will automatically increase rewards in your wallet, removing the need to learn about the stake/unstake process and avoiding an extra tax levy on staking activities.

Insurance fund :

The $Y360 Insurance Fund, abbreviated YIF, is an autonomous wallet in the Y360 YAP system. The YIF is supported by a portion of the buy and sell trading fees accumulated in the YIF wallet, and it utilizes the same mechanism that powers the Rebase Rewards. Simply put, the YIF parameter supports the staking rewards (rebase rewards) that are delivered at a rate of 0.0206 percent every 13 minutes, ensuring $Y360 token holders a high and constant interest rate.

Risk reduction related with the downside: Maintaining stable growth levels to ensure long-term growth continuity Using a rebase technique to ensure pricing stability.

Fire pit :

Approximately 1.5 percent of all $Y360 transacted is consumed by the fire pit. The quantity of burnt tokens is precisely proportionate to the circulating supply; the more that is exchanged, the more that is put to the fire, causing the fire pit to expand in size through self-fulfilling Auto-Compounding, diminishing the circulating supply and maintaining the Y360 protocol stable.

Protocol for auto-liquidity management :

Liquidity may be thought of as a big pool of money split in half by $Y360 and $BNB tokens. For example, there is a conversion ratio set to the amount of $Y360 accessible through BNB: 1 BNB equals 36.44 Y360.

Treasury Yield 360 :

The Treasury is a crucial component of the Y360 YAP protocol. It fulfills three critical functions for the growth and long-term survival of Y360.io. The YIF also receives funds from the Treasury. This additional support may be valuable if the price of the $Y360 token falls precipitously. It helps to establish a floor price for the $Y360 token.

APY Formulation :

The Y360.io technique is built on a straightforward daily-interest compounding algorithm. Where A symbolizes the future worth of your investment and P denotes the initial investment The decimal interest rate is r, and the number of times interest has been compounded in the given time is n. The entire time necessary for investment maturity is denoted by t. It is critical to remember that rate r and time t must both be stated in the same time units, such as months or years. Time conversions for a 365-day year are 30.4167 days each month and 91.2501 days per quarter. There are 360 days in a year, with 30 days each month and 90 days every quarter. In this scenario, if the customer puts $1000 worth $Y360 for a year at 0.0206 percent compounding every 13 minutes, he will end up with a whopping $360,000,000 when his investment matures.

Auto-staking :

The auto-staking system works by automating the reinvestment of staked rewards. To put it simply, staking is a cryptocurrency reward generation mechanism that allows crypto asset holders to lock (invest) their cash in a worthy pool, which will then provide them with a return on their investment. As a result, both sides benefit from a mutual WIN-WIN cooperation.

The process of investing and reinvesting crypto assets in a proper staking pool is nerve-racking. To be sure, it can take a day or more of searching to discover that staking pool, and once found, it is accompanied by huge transaction fees that drench the spirit of the entire staking procedure. This is when auto-staking comes into play.

Auto-staking, as the name implies, is the automation of the reinvestment process. By default, an auto-staking protocol is constructed on the foundation of auto-compounding; the relationship between the two is so strong that the two names are used interchangeably in many literary publications.

As a result, an auto-staking protocol has a good chance of providing its consumers with exponential profits. As a result, the Yale360 can support its maximum fixed APY of 360,000 percent.

More Info :

Website: https://yield360.io/

Whitepaper: https://yield360.io/whitepaper.pdf

Medium: https://yield360.medium.com/

Github: https://github.com/Yield360/

Telegram: https://t.me/yield360

Discord: https://discord.gg/w6utZfyUXr

Twitter: https://twitter.com/yield360

Facebook: https://www.facebook.com/Yield360

YouTube: https://www.youtube.com/channel/UCMDPz2BYaUqSXesPVW_HNwA

Reddit: https://www.reddit.com/r/Yield_360/

Author

Forum Username: forid200

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=3448797

Telegram Username:@mdjoy200