Unveiling the Unsettling Truth: Shenzhen Zhongyuan Real Estate Agency's Struggle Amidst Billion-Dollar Commission Debt from Real Estate Giants like Evergrande, Jiayuan, and Baoneng

In the aftermath of Wanda's desperate struggle for survival, the public plea from Country Garden, and the bankruptcy shield sought by Evergrande USA, an eerie equilibrium has emerged between real estate enterprises and property intermediaries.

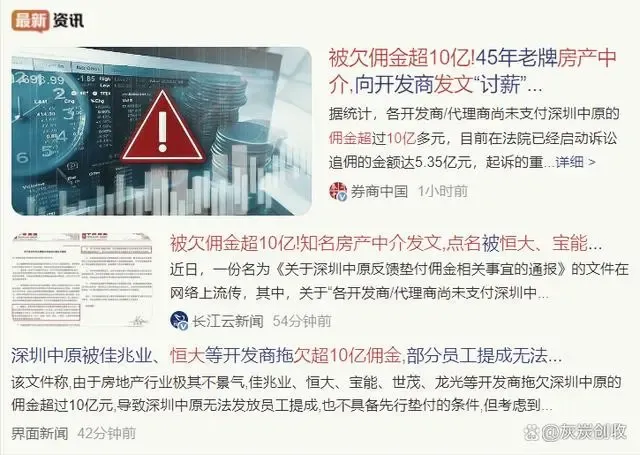

Intermediaries, integral to the real estate realm, find their fortunes intertwined with the housing market's vitality. A prominent real estate agency, Zhongyuan Group, has finally reached a breaking point. Unable to recover outstanding debts, they've resorted to a public declaration on the Internet – this agency is none other than Shenzhen's renowned Zhongyuan Group.

Recent days have seen the circulation of a document titled "Notice on Matters Concerning Advanced Payment of Commission by Shenzhen Zhongyuan," alleging that various developers and agents owe the Zhongyuan Group over a billion yuan.

Reportedly, this document was issued by Zhongyuan Group's CEO, Shijun Rong, on August 11th, 2023.

In line with the document's contents, the real estate sector's recent downturn has triggered fund chain ruptures and failures among several developers, preventing the timely disbursement of sales commissions owed to Zhongyuan Group and its affiliates.

This downturn has dealt a severe blow to Zhongyuan Group's profitability, leaving them mired in consecutive substantial losses, making their operations an uphill struggle.

Presently, the key developers and projects entangled in Zhongyuan's litigations include Jiayuan, Evergrande, Baoneng, Shimao, Longfor, and Jixiangli. However, these developers have been in the spotlight continuously, leaving them with little surplus to fulfill their financial obligations.

According to statistical data, among the debts exceeding a billion yuan, 535 million yuan have initiated commission-recovery lawsuits in court. Of this, court rulings have necessitated the enforcement of claims exceeding 400 million yuan, while pending judgments total over 135 million yuan.

Based on official company information, Zhongyuan Group presently employs over 55,000 staff and operates subsidiaries in 60 cities worldwide, reaching hundreds of urban centers within their business domain. The group also boasts 2,500 direct-operated stores, cementing their role as pioneers and leaders in the real estate agency sector.

As reported by the Shanghai Securities News, Shenzhen Zhongyuan, abbreviated as a major professional real estate agency in the Shenzhen region, operates under the full name of Zhongyuan Real Estate Agency (Shenzhen) Co., Ltd. Since 2001, the company has dominated the Shenzhen real estate market with its property portfolio and sales volume.

However, these intermediaries were of a bygone era, no longer the intermediaries of today! The year 2023 is destined to be a seismic shift for the "real estate intermediary."

Historically, real estate intermediaries were perceived as a low-profile profession due to three primary reasons: firstly, the relatively low entry barrier, a commonality in the entire sales industry, contributing to a lower average skill level among practitioners;

Secondly, the existence of a few unscrupulous individuals and companies triggered the spread of negative word-of-mouth, where bad news traveled far and wide;

Most crucially, the industry inherently faced inescapable issues, such as the pursuit of quick riches and high profits, stoking the flames of greed and eroding ethical standards for some.

Engaging in the real estate intermediary profession didn't exclusively rely on mastering property expertise. Success hinged on the relentless daily grind, of maintaining client connections and conducting property tours, which occupied a significant 70% of one's time.

Moreover, luck played a 30% role, and once a client signed a deal, a share of the profits was yielded to the brokerage company. This process was essentially a workflow, fulfilled once concluded.

Throughout this process, remembering fundamental data sufficed; before each client tour, jotting notes in advance facilitated easy reference.

Interestingly, possessing excessive specialized knowledge didn't necessarily translate to more earnings. Conversely, an excess of knowledge could breed anxiety, negatively affecting performance.

In contrast, a grasp of basic concepts and data facilitated smoother communication. Maintaining strong professional ethics was paramount to building a reputable standing and favorable reputation.

Different homes carry distinct values, especially for ordinary families. Purchasing a home constitutes a substantial investment, involving savings and decades of future mortgage payments. For ordinary families, the risk of trial and error is too substantial.

Buying property not only taps into personal savings but also impacts the assets of the elderly and the future decades of the entire family's livelihood.

The forthcoming years foreshadow a profound upheaval in the real estate intermediary sector. Those relying on deceit as their modus operandi will be among the first casualties, while those unwilling to enhance their skills will face abandonment by the market.

Ultimately, the surviving intermediaries will be those who empathize with clients and landlords, viewing matters from both sides of the transaction and providing service with diligence and professional acumen.

Only intermediaries who possess empathy, approach matters from the perspectives of clients and landlords, and deliver stable and reliable service will stand out amidst industry competition.