The 11 U.S. Bitcoin spot ETFs have net inflows for 9 consecutive days! Total assets reach US$57 billion

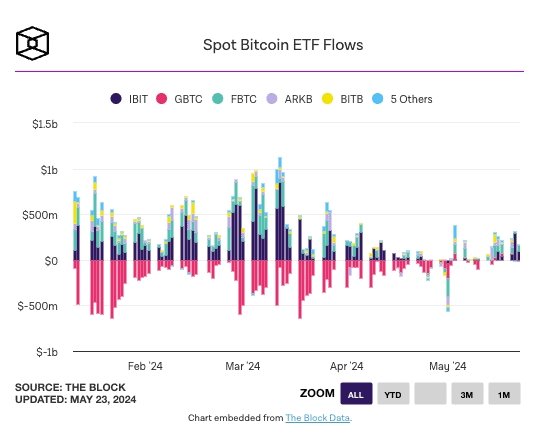

According to data from SoSoValue, 11 U.S. Bitcoin spot ETFs attracted more than $107 million on Thursday, marking the ninth consecutive day of net capital inflows.

Looking further at the performance of various funds on May 23, BlackRock’s IBIT topped the list with a net inflow of US$89 million; Fidelity’s FBTC followed closely with a net inflow of US$19 million. Subsequently, the VanEck Bitcoin Spot ETF saw a net inflow of US$10 million; while the two Bitcoin Spot ETFs, Ark/21Shares and Invesco/Galaxy, each recorded a net inflow of US$2 million.

Grayscale's GBTC had a net outflow of US$14 million on Thursday, while the remaining five Bitcoin spot ETFs recorded zero net inflows.

Since its listing in January this year, the cumulative net inflow of 11 U.S. Bitcoin spot ETFs has reached $13.43 billion.

According to data tracked by HODL15Capital, these 11 funds currently hold a total of 850,707 Bitcoins (worth approximately US$57 billion), a record high. Among them, Grayscale’s GBTC holds 289,300 Bitcoins (worth approximately US$19.3 billion). ) ranked first; BlackRock’s IBIT ranked second with 283,200 Bitcoin holdings (worth approximately $18.9 billion).