Attempt to calculate how much of bitcoin transactions are speculative

As I talk to more people about cryptocurrencies, regularly, the question comes up how much of it is pure speculation.

As the blockchain is more or less anonymous, we actually don’t know. So I thought about the next best thing.

A 24 hour volume analysis of the blockchain versus exchange traded bitcoin.

Exchange traded bitcoin = ∑ 24 hour Bitcoin volume on exchanges / ∑ 24 hour Bitcoin volume in the blockchain

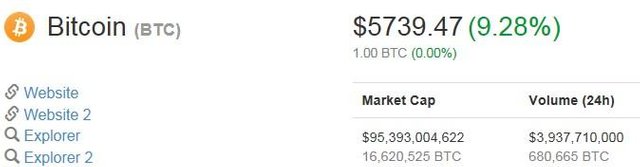

According to Coinmarketcap, the volume of Bitcoin traded in the last 24hours is BTC 680k and the blockchain recorded transaction for BTC 1826k

Exchange traded bitcoin =680’665 / 1’826’794 = 37%

Of course, this doesn’t give a good view for many reasons.

Exchange trades are not recorded on the blockchain. We would need to assume that the seller first sends BTC to the exchange, then trades with the buyer and the buyer sends BTC to a wallet. That actually takes 2 blockchain entries, so the blockchain volume for an exchange trade is double counted – if both traders don’t leave BTC in their exchange wallet.

*Exchange traded bitcoin = (2 ∑ 24 hour Bitcoin volume on exchanges) / ∑ 24 hour Bitcoin volume in the blockchain

Exchange traded bitcoin = 1'361'330 / 1’826’794 = 75%

Of course, the percentage would be lower if traders leave their bitcoin on the exchange. (Because the factor 2 would then decrease).

But I’m not sure if OTC trades are included in the volume traded on Coinmarketcap. If not, this would increase the percentage.

As these factors are both unknown, but have a balancing effect, I could live with the conclusion that approximately 75% is used for speculation and 25% for purchasing goods. Of course there are a lot of other factors that play a role, like the 24 hour time window, but one could consider doing this daily to see if exchange trades are having and increasing or decreasing volume.

Does this make sense? Please be kind if I’m writing nonsense 😄

Please let me know your opinion!

Source: Coinmarketcap.com on 13/10/2017 (17:00 CET)

Source: Bitinfocharts.com/Bitcoin on 13/10/2017 (17:00 CET)

This post was resteemed by @reblogger!

Good Luck!

Learn more about the @reblogger project in the introduction post.

Really interesting read and a nice break from all the usual charts being reposted. While Bitcoin has the name recognition and awareness from being #1, I think the space is young enough that it will be another coin, perhaps one that hasn't even been created yet, that will lead the shift from speculation to adoption. Of course, a Bitcoin being worth almost $6k after 9 years doesn't hurt either ;)

Very interesting. Is this 75% of the market cap is devoted to speculation or 75% of transactions?

If the latter I'd like to respectfully disagree :-) Only 75% of transactions going to speculation sounds really low. Consider that the velocity of trading might be 365 (the currency changes hands daily) while the velocity of daily use currencies like USD is typically 5 (changes hands only 5 times per year).

Let's look at this another way: From Bitpay they say that they are doing $1B in transactions per year, with a velocity of 5 means they are only moving around $200M worth of bitcoin (in market cap), about 0.1% of market cap. Their daily volume is $3M which is only 0.05% of the $6B daily volume, assuming bitpay accounts for 1/100th of non-speculative transactions, only 5% of daily transactions are non-speculative and I don't think there are 100 Bitpay-like companies out there. 5% of transaction value being non-speculative sounds like the higher end of the spectrum.

What do you think?