Bitcoin's Scaling Debate - My money is on Segwit

If you’ve heard of Segwit, Block Sizes and Bitcoin Forks and Transaction Delays lately, but don’t quite understand what it means for you, you’re in the same boat as me.

The Bitcoin Blockchain as a technology is great, but it not perfect. During its existence, there have been changes to it, but the ecosystem has evolved at such a rapid pace, that in a way, bitcoin has failed to keep up.

Over the past couple of years, various groups have put forth their perspectives on how to the blockchain can be upgraded in order to keep pace and make it more secure (I will not be going into transaction malleability etc in this post)

Where we are today

When Bitcoin first broke the $1,000 barrier in 2013, it attracted a lot of attention globally. As merchants, miners and investors flocked to Bitcoin, daily transactions crossed 100,000 for the first time.

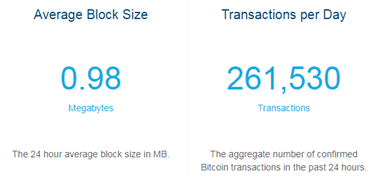

A quick look shows a 3.5x increase in daily confirmed transactions since 2013. 367,000+ transactions were confirmed in a single days in May 2017. While this pace has lowered over the past month, we are still witnessing over 250,000 txns on a daily basis.

source: blockchain.info

How we got here

When Satoshi Nakamoto created bitcoin, he limited block sizes to 1mb. One of the reasons for doing so was to make the Blockchain more secure from external security threats.

This design allowed for a fixed number of transactions possible in each block every 10mins.

While bitcoins growing acceptance and relevance is great news, each block is filling up to its maximum capacity.

source: blockchain.info

Transactions are spilling over into the mempool - causing delays, frustration and most importantly costing people money due to the often ridiculous transaction fees.** As a result, miners often confirm transactions that attach higher fee, leaving smaller transactions in the wind.

source: bitcoinfees.21.co

It would be unthinkable to order a latte at Starbucks and waiting 13mins for your order to be placed while visa

As things stand today, this makes bitcoin unviable as a transactional currency.

Fixing Bitcoin

To a non-techie like me, increasing the block sizes – to stuff in more transactions and reduce delays would be the logical solution. More people would accept and use Bitcoin daily and it will replace the Dollar in no time.

Luckily, there are brighter minds than mine, working hard behind the scenes to come up with solutions. Bitcoin’s core developers (a group of developers that are responsible for what’s under the hood), large miner groups, crypto exchanges have been debating that best solutions to this problem for a couple of years now.

Diverging Perspectives

Unfortunately, different groups have different perspectives. The core devs don’t want to stray too far from Satoshi’s doctrine, the miners don’t want to lose their share of the fee, the exchanges like CoinBase – well, who knows which solution they will support.

In May the Digital Currency Group (DCG) organized Consensus 2017 attended by the leading stakeholders to try to come to a consensus over how to scale bitcoin to meet today’s demands. After over 2yrs of locking horns, the stakeholders agreed to implement Segregated Witness 2mb proposal (Segwit2x)

Over 58 companies that represent 83%+ of the global hashing power agreed and Segwit2x would be activated if

*80% of the network signaled for Segwit2x

Resulting in

*activation of a 2mb hard fork within 6 months

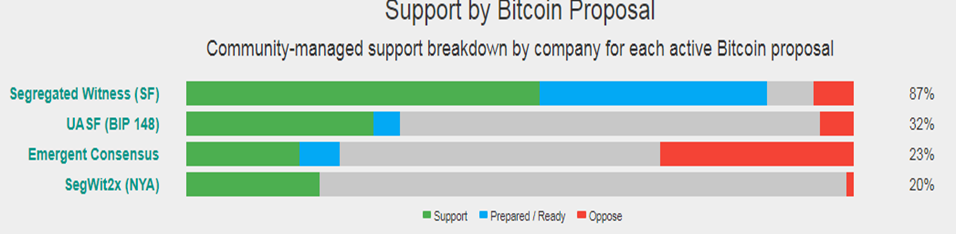

While Segwit has received the required support, there are those that don’t agree with the proposed solution.

If this status quo continues, Bitcoin is headed for an inevitable fork that would lead to the creation of 2 coins and 2 blockchains.

Forks – not the ones you eat your noodles with

In laymans term, a fork is a change /upgrade to software. As it relates to Bitcoin, there are two possibilities/forks

Hard forks are those that are incompatible with previous versions of the software. In order to use the features in these versions, one MUST UPGRADE to the new version. For the most part, there is no going back.

Soft fork are those that are compatible with previous versions of the software. These upgrades are voluntary and allow all users to access the new features

Think of it in terms of Windows evolution from XP to Vista to 7 and now Windows 10 (lets not talk about 8). Microsoft provides routine updates/patches to improve the OS and fix vulnerability. Over the years, Microsoft continued to provide updates to XP (until a couple of years back) – allowing XP users to enjoy new features. These updates can be thought of as soft forks.

As we have transitioned away from XP, Microsoft stopped providing updates/upgrades for it. Some of these features may be desireable to XP users, but the only way for them to access these features. XP users would be forced to upgrade to Windows 10. This would result in a hard fork.

What the future holds

As of today, there are two major groups fighting over bitcoins future – Core Devs (BTC) vs. Roger Ver & Co.(BTU). Assuming that a consensus is not achieved before the Aug 1st deadline. Both groups will release their “update” to the blockchain. Since these will be incompatible, BTU will essentially fork off into its own blockchain.

At this stage, miners – those of us that put up our computing power to confirm bitcoin transactions will have a choice to make.

- Upgrade to Segwit and mine BTC

- Upgrade & mine BTU

Choosing the better poison

Miners will have a big decision on their hands – and it will not be an easy one

Though Segwit has received the min signal for activation, this is not set in stone - the community continues to be divided.

source: coin.dance

The chain which receives the most support from miners, exchanges merchants and users will be the one that likely succeeds. However, as has been the case with Ethereum and Etheruem Classic – 2 chains continue to survive.

What this means for you??

Simply put, you will end up with coins on both chains - 100BTC after a hard fork = 100 BTC + 100 BTU

As a holder of bitcoin, this will be impacted by where you hold your coins. We all have a decision and I hope that you make the right one.

There is no way the chain is going to hard-fork because of SegWit. None of the parties are gaining anything from that. Those are some smart people, they won't gamble with Bitcoin split.

With current amount of transactions per day, we don't need bigger blocks. I know that in the New York Agreement they agreed to 2Mb blocks in 6 months after SegWit is activated. But than again it requires a hard-fork. So I can see many ditching NYA if the 2Mb blocks are not a necessity by than.

Hopefully sanity prevails - a fork will cause chaos - replay attacks, confirmation delays etc. and surely cut into BTC's price.

However, we cant ignore the threats from roger ver, visaBTC etc. They control a sizeable portion of hashing power. Not having to pay mining fees, bonuses etc . will likely attract some.

Craig Wright - who once convinced a few in the community to be Satoshi Nakatmoto has again managed to bring some attention on himself