On Capitulation and Bitcoin's Bloody Black Friday Weekend

Well, crypto peops, it’s fairly obvious that capitulation is upon us. What's that? You thought it was already here and went long on BitMEX with 100x leverage? On that kind of trade 15% of your position just goes to cover the fees!

Whoops... and... it's gone.

That's what they say these days at least. The once powerful meme mines of Crypto Land have been recently reduced to repeating South Park over and over again. These are desperate times, but we haven't hit despair yet. (More on that later.)

The only question to ask now is, “How low can you go, bitcoin?” The question is hella appropriate given the growing likelihood that King Bitty is definitely drunk on vacation on some tropical island playing a game of Limbo.

Ethereum has gone off to Antarctica, a place no one, not even good old VB, ever thought it would ever go again. Double digits. The poor kid's fortune has gone from something like a half billion to somewhere around $50 million. If he cared the least bit about money, he'd probably be devastated.

But the best minds in crypto - VB, Charles Hoskinson, Matt Spoke - DGAF about money. They kinda guessed the nature of the people that had come into the space in 2017 and 2018, as evidenced by this quote from VB, "I'm skeptical that people involved in cryptocurrency are better people than people involved in the banking system."

That's a nicely sobering thought for a 24-year-old.

And while pretty much every other altcoin is down a dizzying amount, most more so than the Big Daddy BTC, we and the entire blockchain industry really need to keep in mind another VB quote from that same Forbes interview, "If crypto succeeds, it's not because it empowers better people. It's because it empowers better institutions."

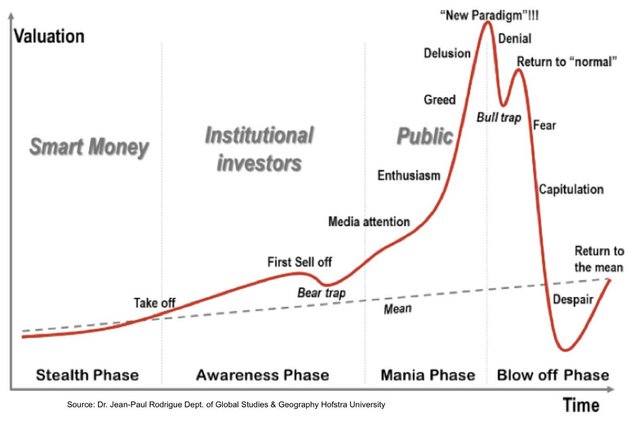

Investor psychology can be a real bitch. Especially when there are no accepted valuation models to properly value cryptocurrencies. As such, the capitulation downswing in a blow off phase like the one happening during this bloody weekend in crypto is being driven completely by investor psychology. Thus, it can go quite a ways down.

Note in the following life cycle of investment, though, that capitulation is not the last stage in the investor sentiment cycle. Yes, it is the stage which can encompass the longest and most significant price decline in percentage terms, but it is only after a very healthy dose of capitulation that we get to despair, where we can then, and only then, finally start to hope and dream about a "return to the mean." Never mind the dizzying heights of the "New Paradigm"!!!

I think we still have a little ways to go still before full despair, but god knows we’re a whole lot closer to it than when the bell rang on the stock market on Black Friday. These 24/7/365 markets really do a number on investor psychology. That's why it's probably best to prepare yourself going forward like a Zen Master would.

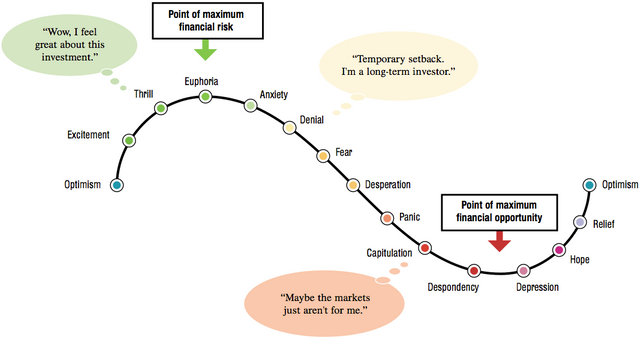

So I'll leave you with this little great resource from OptionAlpha in the hopes that we all, myself included, can do better next time. And to remember what our emotions feel like, really viscerally feel them and capture them, when it's time to buy... and when it's time to sell.

In the meantime, everybody... Limbo!

No one escapes unhurt in a new market that no-one really knows what will happen to ! But, like Steem users who enjoyed using Steem, and experienced the magic of money buzzing around a platform in Jan 2018, we invested in Steem. And now we hodl because we still believe in what it can do...

Yeah, I believe in STEEM. As my Facebook usage amount crashes like the crypto market, my steem usage correspondingly increases. This platform, or something very much like it, is definitely the future of social media IMHO.

Posted using Partiko iOS

Caught in the bull trap at 6,400. Feelsbadman.

Never invest what you can't afford to lose and always, always scale in and scale out.

No one can predict the short term movements of something as esoteric as a digital asset. And if they tell you they can, they are simply just lying to you!

Don't buy bitcoin at $6400 because you want to get rich quick. Buy bitcoin at $6400 because you are starting to build a position for the long term and are willing and able to commit more to it at even lower prices. If you aren't thinking in that way, then honestly you shouldn't have put on the position in the first place.

It takes a while to master the emotions and the logic necessary to make money investing, and I'm not so great at it yet either. But I'm definitely better at it then I used to be! And it's that slow progress that matters.

I wanted to put this link in the original post, but couldn't find it until today. In combination with the OptionAlpha graphic, I feel like that is a pretty good way to start making better investments. It's called the Crypto Fear & Greed Index and it's done by alternative.me.

PEACE ✌🏼

"And to remember what our emotions feel like, really viscerally feel them and capture them, when it's time to buy... and when it's time to sell."

great quote ... it's always tuff to stomach it

but that's also why i don't think steem is going down to $0,10 , that's also just wishful/denial thinking... it won't be that easy

Thanks. I always seem to know when it's time to buy... by the feeling of almost throwing up when you're about to hit the buy button. But I never ever know the feeling of when it's time to sell. Starting to get it, I think. It must have something to do with saying "Naw, why would I sell? I BELIEVE in this XYZ investment! I am a long-term investor." That's the real contrarian soul-searching I have yet to do to learn to tell myself not to be an idiot and just take the gainz. Or at least some of them.

ni hao! new follower xie xie (-:

Wow! Thanks. And you can speak Chinese? 你也可以读汉语吗?

not really, but my daughter has been studying for 2 years and i started some CDs now in the car. (-: peace

Hmmm informative 😊

Posted using Partiko Android

I like the way of your writing; big daddy BTC. And those graphs are really helpful I think.

Thanks! I think STEEM kind of allows me to write more freely and I like that A LOT! I can't stand a big block of text so paragraphing is important to me. Glad you appreciate that.

thanks for sharing your assessment of situation and interesting info like that 14 stages of investors emotions...

IMO "Capitulation" is just some fancy word, a gimmick more like. :)

I mean, the whole thing about so called "Crypto Bubble" (or a Bitcoin bubble) is in itself a huge Bubble, i.e. blown out of proportions!

by those very institutional guys (such as Jamie Demon) who keep generating the FUD about Crypto in MSM, while at the same time buying Crypto OTC. LOL

to elaborate a bit more: at the pick of Bitcoin ATH, the WHOLE entire Crypto Total Market Capital was like what, just about half trillion USD?

which is insignificant even comparing to the daily trade volumes on Forex, as I recall (over $5trln ?)

and now that Total Capital has dropped to almost $100blns according to CMC? (alright, at $122bln approx. at the moment)

that's ALL the Cryptos together! :D

BTC at around $66bln LOL !!!

so, I mean, "Capitulation" I think is more like sort of NLP word used by some tricksters, for their own agenda and tricks (FUD / FOMO etc)

so far in fact Cryptos performing a lot better than some other assets and commodities - should not forget that! :)

as well as the fact that a lot of other markets are in downturn.

comparing to which Cryptos are not so bad at all.

personally I tend to agree with those who opine that this whole thing is mostly artificially FUDded, for the ulterior motives of those very institutional investors who force "weak hands" to sell off, to be able to buy off them whatever they sell in their desperation.

although another considerable partial reason: all those complications, restrictions, regulations... CBDCs, stablecoins, etc... advent of "crypto-fiat"... it won't be a surprise if quite sooner rather than later Cryptos would be if not entirely outlawed, then very hard to obtain and all those who were into it - would be sort of "encouraged" or lured or "forced" into all those "institutional" and "corporate" digital tokens, "crypto-llike".

but apparently there are still some very staunch "strong hands", aka stubborn HODLers! who do not give up so easily and neither are being easily fooled by some FUD and fancy gimmicks (as "Capitulation"). that I suppose one of main reasons why Bitcoin is still showing certain support levels and not drops to $2000 or $1000 as many predict or wish it would... or not as fast as they have expected...

Really happy to have inspired you to write so much here. And thanks for sharing!

I agree with much of what you said, though "capitulation" to me is psych vocabulary (ok, you can call it psychobabble if u want!) that helps us to understand our emotions better. When we are going through it, we need to understand that emotion and put a name on it so we can remember it... And use THAT to be a better investor!

I don't think we'll ever know why this knife is falling right now, though the fact that it's a holiday weekend, that other markets all around the world are weakening - oil, non-USD fiat, stock markets everywhere, etc., and also I still think old CSW is up to something - he won't just go that soundly into this sweet night. All that and more seem like decent reasons for us to be down a lot. But in the end, who knows? And it doesn't matter, in the long run at least.

It'll be a helluva case study one way or another!

When $1K? I’ll buy all the BTC I can afford if it gets that low.

I think the lowest we could see is around $1800, which is the low right before the original BCH fork. But honestly, no one knows the short term price of these things. There’s no underlying business model or cash flows, which means none of the traditional valuation methods work! The only truth we know is use=>value. But we don’t really know how to quantify use into value, if you know what I mean.

Posted using Partiko iOS

I DO know what you mean. I just wish I knew it last year! LOL!

BTC almost back above 4k now. What is interesting to me is just how many retail holders from the market peak are still remaining in the market at present. I would guess not many, it is clear over the past few months that there are some serious players in the market that are driving price action, for all the talk of institutions I feel they are already involved in the market.

Lots of institutional investors have dipped their toe in. But i don’t think they’ve really come in full freight. And why would they when we’ve been dead cat bouncing since January? They are building their teams, testing strategies, asking questions, doing all the right things to lay in wait. They don’t need to rush, so they don’t.

Posted using Partiko iOS

Thank you for using @entrust!

You got a 74.23% upvote from @entrust courtesy of @shanghaipreneur!

Entrust is a bot focused on rewarding delegators and helping users promote their posts. We give 100% of the total rewards to the delegators with payouts will be given daily. If you would like to consider delegating to @entrust, we've made a quick delegation link for you :

10000 SP | 5000 SP | 1000 SP | 500 SP | 300 SP | 200 SP | 100 SP or visit our own tracker website for more information :