Why do the prices of most cryptocurrencies follow Bitcoin's price?

You may have noticed that whichever direction Bitcoin goes, it seems that just about every other cryptocurrency follows Bitcoin's price. Are people just intentionally following the price of Bitcoin in their respective cryptocurrencies? Well, that's not exactly true. It's a bit of an illusion but it's part of a wider problem with the crypto market as it stands.

To fully understand this, we need to go back in time.

Genesis

First there was Bitcoin. People wanted a quick and easy way to exchange Bitcoin with each other for fiat like USD and EUR. This is when the first Bitcoin exchanges started appearing. These exchanges allowed you to deposit fiat into the exchange and trade your fiat for BTC. This results in what's called a "trading pair". A trading pair is where you have a market where you can trade one asset for another. In this case the trading pair would be known as "USD/BTC". Then came Litecoin, Namecoin, SwiftCoin, Peercoin, Dogecoin....okay, you get the point, tons of new cryptocurrencies started appearing.

So now with all of these new cryptocurrencies appearing, a problem arose. A lot of these new cryptocurrencies had different protocols and thus required a lot of effort on the part of exchanges to add them. Most of the original exchanges were likely coded to only be able to handle one cryptocurrency very well and adding new ones was a large chore. Not only that, but when you are dealing with trading cryptocurrencies for fiat as a business, it introduces a ton of legal hassle and problems with banks etc. Running an exchange in terms of technical requirements is difficult enough, adding on legalities in dealing with fiat is another ballgame entirely. These existing large exchanges dealing in fiat mostly didn't want to deal with new cryptocurrencies until these new currencies at least established themselves as being somewhat useful and not just a basic fork of Bitcoin. It was just too much work for something that may be worthless.

So someone came up with a solution.

The cryptocurrency only exchange was born

Someone decided that this was an easy problem to solve. Forget dealing with fiat, they'll just use BTC as the base for all cryptocurrency trading pairs. So that means we'll have BTC/ETH, BTC/LTC, BTC/DOGE and so on. When you go onto these exchanges, you can deposit any cryptocurrency and trade it for Bitcoin. Alternatively, you can buy Bitcoin, send it to the exchange and then trade your Bitcoin for any of these new cryptocurrencies which are not normally available on the big exchanges that deal with fiat currencies.

That means far less legal hassle and also the exchange doesn't have to have much dealings with traditional banks. All of their profits can be earned in BTC fees.

These exchanges fast became extremely popular and make enormous amounts of money from trading fees. Each trade costs a BTC fee and each withdraw from the exchange into another account costs a fee.

It's worth noting that some of these exchanges have ETH based pairs and USD-T based pairs but the vast majority of trading in all cryptocurrencies is still done against BTC based pairs.

The cryptocurrency index websites

Websites like CoinMarketCap are extremely popular with people to see the "value" of cryptocurrencies. Most, if not all of these websites display the value of every individual cryptocurrency in a fiat currency like USD. However, there is a major problem with this. Remember what I was talking about a minute ago? Most cryptocurrencies do not trade against USD but trade against BTC. The price you are seeing on these websites is almost always the price of the cryptocurrency in BTC, converted to USD at the current going rate of BTC/USD. This might be confusing so let me show you an example.

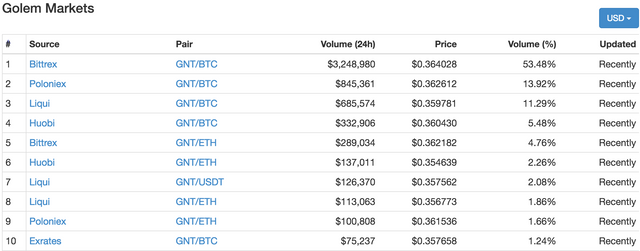

When you click into a specific currency on CMC, such as Golem and you view the markets tab, you'll see the source of the price of Golem:

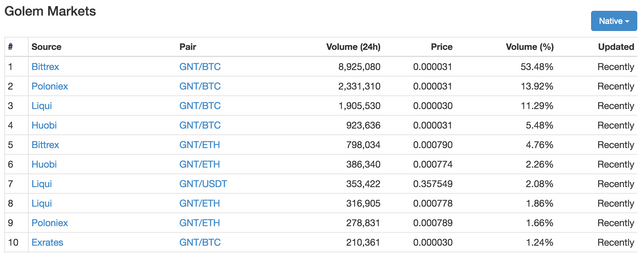

Now what do you notice? Look at all of the pairs Golem is trading on in these markets. There are almost no fiat pairs. The vast majority of trading volume is not coming from USD, so where is the price of Golem in USD coming from!? Well, the price in USD you are seeing is the price of the cryptocurrency it is trading against, converted to USD. Change the dropdown to "native" to get the real value of Golem:

What you are seeing in this screenshot is the actual price of Golem in the respective currency it is being traded against. When you view prices in USD, these websites are converting it from the currency it is being traded against into USD and then averaging all of the prices to give an estimate of the going price.

So when the price of Bitcoin changes, since the vast majority of prices are actually based on BTC, then the price in USD appears to drop. Some cryptocurrencies now have healthy volume in fiat currencies, such as Ether and NEO. A lot of the trading volume of these two currencies is still on BTC pairs mind you. There is however, enough volume in fiat pairs for these two currencies (and some others) to differentiate them from the trend of Bitcoin somewhat. You may have noticed this yourself in the past.

You can actually change the display price on these websites to BTC most of the time. When you do this, particularly during a major price movement, you'll notice that often the price in these other cryptocurrencies in BTC is not actually changing, certainly not as much as their BTC value converted to USD price is changing.

Conclusion

This situation is rather unfortunate because it means that almost every cryptocurrency is strongly tied to Bitcoin, even those that have grown to have strong volume in fiat pairs on big exchanges. The reason these websites show the price in USD by default, making the situation more confusing, is because it's just easier for people to understand. Most people don't know what Ether costing 0.05 BTC means but they do know what Ether costing $500 means. The reasons the exchanges use BTC as a base is because it's easy and it's what everyone else is doing. All hope is not lost, some exchanges have been combatting this by trying to add more base pairs.

Bitfinex has quite a few fiat pairs and Korean exchanges tend to add a lot of cryptocurrencies on KRW based pairs. Other exchanges like Bittrex and Liqui have added USD-T and ETH pairs in an attempt to help resolve this problem.

Unfortunately the vast majority of trading is still done against BTC at the time of writing this article and will likely stay this way for a long time. Hopefully we start getting more exchanges which are willing to add fiat pairs with all cryptocurrencies and start moving away from BTC based pairs everywhere.

The good news is that more recently there has been a large effort towards fiat base pairs being added for more and more cryptocurrencies. Bitfinex has added USD base pairs to most of the currencies on their platform, Binance has discussed adding fiat to their platform as they are moving to Malta to become officially regulated, Coinbase is looking to add more currencies to their platform and is mostly awaiting clarity from the SEC.

One can only hope that these changes come sooner rather than later so that we're not at the mercy of the price of Bitcoin so much anymore.

Originally posted on Cracklord.com and edited slightly for steemit.

Hello,

We have contacted you on Twitter to verify the authorship of your Steemit blog but we have received no response yet. We would be grateful if you could respond to us via Twitter, please.

https://twitter.com/steemcleaners/status/1106551504926846976

Please note I am a volunteer that works to ensure that plagiarised content does not get rewarded. I have no way to remove any content from steemit.com.

Thank you

Bitcoin will always be the least volatile and the best to own at all times.

Lets hope crypto stops following Bitcoins rise and fall as currently it renders the crypto platform useless. You might as well just invest in Bitcoin if everything else follows it.

I want to see another crytpo take Bitcoins place and lead or at least for cryptos to become independent of Bitcoin.

Great post and thank you for sharing.

You nailed it. But I would hope that rather than more crypto being available for purchase in fiat, the situation resolves itself by crypto of all kinds being more rapidly adopted for real world use, so that fiat disappears and the price of individual cryptos is determined by supply and demand vs other cryptos, not by its value in fiat.

This, without your explanation, was what I envisioned. I summed it up to no matter how you cut it if you want to cash out of a coin not paired to USD you had essentially three paths BTC, ETH or LTC. As long as your pathway is limited coin value will flow essentially in the same direction as the coins that are tradable with fiat currency.

Namecoin was before Litecoin to be precised

BTC doesnt control the prices necessarily given how much of the market it control 38-40% it sways some opinion but there has been plenty of coins/tokens that have depreciated while BTC prices rise and as BTC has dropped plenty have seen gains or a tad more stability soon BTC will have far less to do with any of that as cryptos become more mainstream like BTC but I wouldnt say watch BTC when making decisions on purchasing/mining etc.

This post has received a 6.21 % upvote from @boomerang.

You got a 18.70% upvote from @emperorofnaps courtesy of @cracklord!

Want to promote your posts too? Send 0.05+ SBD or STEEM to @emperorofnaps to receive a share of a full upvote every 2.4 hours...Then go relax and take a nap!

Gj man ...just gj