Cryptocurrencies Market Overview, January 18 - St. Louis Fed Sees Bitcoin As Digital Gold

Welcome to my Cryptocurrencies Market Overview for Thursday, January 18, 2018.

This was published by the The Federal Reserve Bank of St. Louis today:

“It is likely that cryptoassets such as Bitcoin will emerge as their own asset class and thus have the potential to develop into an interesting investment and diversification instrument. Bitcoin itself could over time assume a similar role as gold.”

And...

“As an asset, however, Bitcoin and alternative blockchain-based tokens should not be neglected. The innovation makes it possible to represent digital property without the need for a central authority. This can lead to the creation of a new asset class that can mature into a valuable portfolio diversification instrument.”

And...

It could be argued that, in some ways, the Bitcoin protocol is more robust than many of the existing fiat currency protocols.

Wise words! I didn't expect that from a central bank.

Here's the full paper:

A Short Introduction to the World of Cryptocurrencies by the St. Louis Fed.

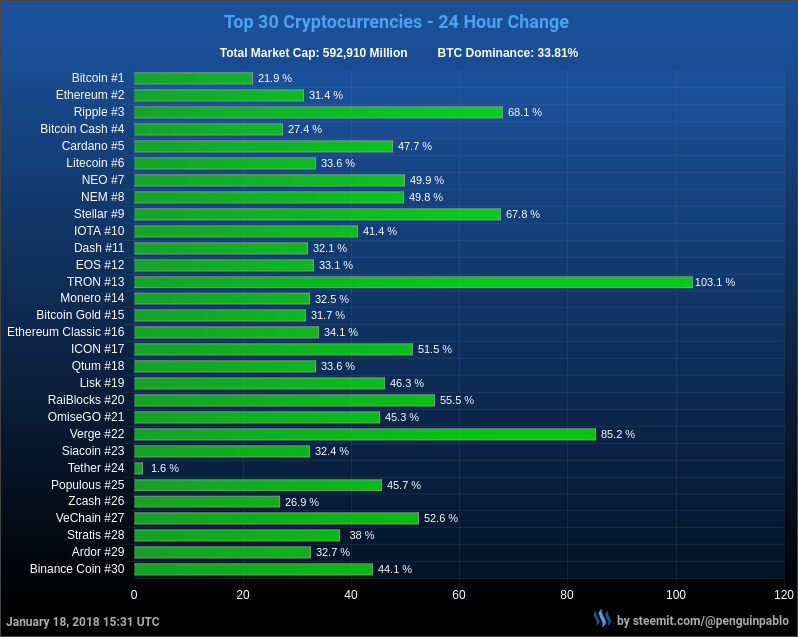

24 Hour Change

Realtime chart on my website CoinMarkets.today

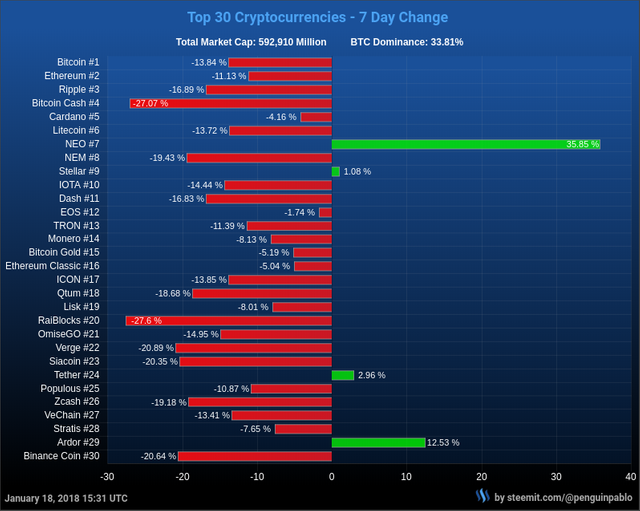

7 Day Change

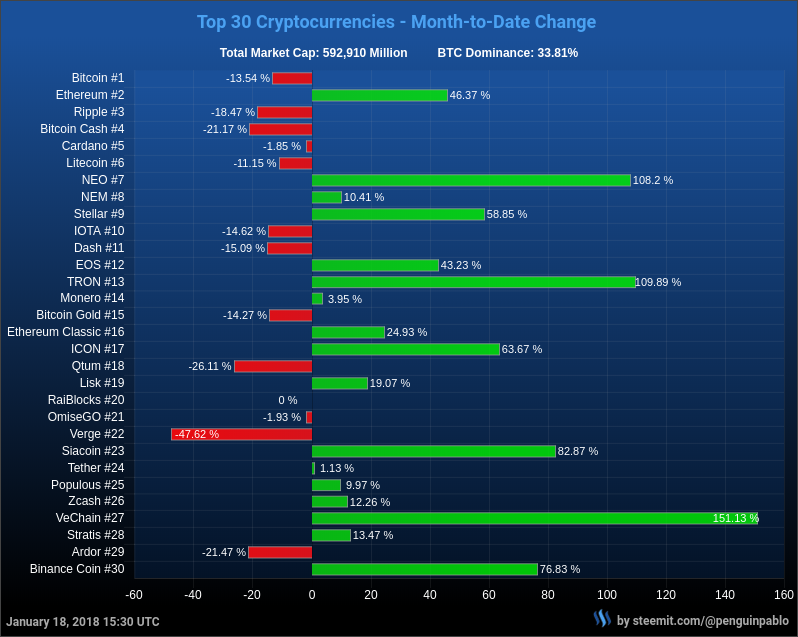

Month-to-Date Change

24 Hour Volume

Market Capitalization

Bitcoin daily chart

Feel free to use and share my charts, but please mention me as the author.

Latest Crypto News - January 18, 2018

Cryptocurrency Market Recovers as Bitcoin, Ethereum, et al. Spike 20%

After experiencing a 2-day slump during which the price of most cryptocurrencies including bitcoin, Ethereum, Ripple, and Bitcoin Cash declined significantly, the cryptocurrency market has started to recover.

Read more: ccn.com

More sources:

- Green Light for Crypto: Market Gets Back on Its Feet

- Bitcoin Is Back Above $11500, But Bulls Not Out of the Woods Yet

- Bitcoin’s bloodbath was totally normal, and now offers ‘the biggest buying opportunity in 2018’

St. Louis Fed Sees Future in Crypto As Important Asset Class, Bitcoin As Digital Gold

The Federal Reserve Bank of St. Louis has published a paper entitled “A Short Introduction to the World of Cryptocurrencies” with an overall favorable assessment of digital currency and Blockchain applications for the future.

Read more: cointelegraph.com

South Korean Officials Caught Trading On Insider Knowledge of Crypto Regulations

South Korean government officials have reportedly been caught insider trading. They sold all of their cryptocurrency holdings and profited just before the regulators announced crypto regulatory measures. The country’s Financial Supervisory Service is investigating the case.

Read more: bitcoin.com

Other sources:

- South Korea: Gov’t Officials Accused of Crypto Insider Trading

- Korean Regulator Investigating Staff Insider Trading of Cryptocurrencies

GDAX Starts BCH Trading, Users Angry About Focus

GDAX has started trading Bitcoin Cash (BCH) this morning as of 9 AM PST, with little fanfare.

Read more: cointelegraph.com

Cryptocurrency Activities Will Be Legal and Tax Free in Belarus Starting in March

The decree signed by Belarusian president Alexander Lukashenko which legalizes cryptocurrencies, initial coin offerings, and smart contracts, will enter into force in March. Cryptocurrency activities are not restricted by the decree and will be tax exempt until 2023.

Read more: bitcoin.com

First Bitcoin Futures Contract Expires At $10,900, ‘Win for Bears’

The Chicago Board Options Exchange (CBOE)’s first Bitcoin futures contract closed Wednesday, Jan. 17, at $10,900 after a relatively turbulent week in the crypto market had briefly brought Bitcoin’s (BTC) price below $10,000.

Read more: cointelegraph.com

Tapscott on South Korea Crypto Ban: It Could Mean Economic Ruin for Decades

Don Tapscott, blockchain advocate and best-selling author, believes that South Korea would be doing the world and itself a disservice by banning cryptocurrency trading within its borders.

Read more: cryptovest.com

Bitcoin Sucks, But Don’t Underestimate Bitcoin 2.0 (Lightning Network)

The deployment of Lightning will be the biggest change to Bitcoin ever. If it works, it reintroduces Bitcoin as a usable daily currency, unhindered by stuck transactions and high fees.

Read more: hackernoon.com

‘Impossible’ to Shut Down Cryptocurrency Exchanges, Govt. Lacks Authority: Korea’s Fair Trade Chief

The chairman of Korea’s Fair Trade Commission – the economic competition regulator – has blasted efforts to shutter cryptocurrency exchanges before calling on the government to regulate the industry instead.

Read more: ccn.com

Hardware Wallet Maker Ledger Nets $75 Million in Series B Funding

Ledger, the France-based maker of hardware cryptocurrency wallets, has raised $75 million in Series B funding.

Read more: coindesk.com

With central bank endorsement and lightning network implementation plan, finally Bitcoin has some good news. It can now resumes its UP journey again. This UP journey will intensify to few altcoins such as STEEM for which big events are still ahead: easy-signup, hivemind in HF20, SMT, airdrop of SMT based ICO (e.g. VICEcoin) etc.

Seems like Neo is staying strong.

This is very interesting that the Fed as changed its tune on Bitcoin. I don't know if this is a good thing or a bad thing! Only time will tell! I would guess it is a positive!

yes, Im always skeptical to anything I hear from the Federal Reserve. You never know what kind of evil plans they have up their sleeves.

Fed heavily invested in crypto and now in panic publish hype documents? :)

Feds:”We need the market down!”

Feds again: “Whoa there, not that far, just enough to buy back in.”

Ugh.. unfortunately you are exactly right! It has been like that for a long time and it usually has a sinister underlying reason! I keep hoping for the infamous “this time is different” but unfortunately it never is

what do you think about NCT coin? @penguinpablo

Wow what a comprehensive post on BTC and Alt coins. Thank you so much for putting it all in an easy to read and navigate forum. Keep up the good work! Cheers

Slowly, the coins are erasing the last 7 days of FUD.

Thank you for the update, it's always really helpful when I see your posts like this because it saves me compiling a lot of information.

It is very interesting to see a central bank making these sorts of claims. with another bank announcing a cryptocurrency exchange, it really seems like banks are trying to get in to the markets.

That was definitely not expected. Especially where he realized it's a new type of asset, which surprisingly isn't obvious to some.

Great post! This contains a lot of interesting information. I have resteemed and upvoted this post to help share it with others. I am also following you on steemit, so I can learn from the information you are sharing.

Cryptocurrency is the talk of the town. Others will follow The Federal Reserve Bank of St. Louis sooner or later; sooner the better.