Thought Experiment: What would be the effect of crazy-high SBD interest?

Continuing our thought experiments about interest payments on SBDs, let's now consider the case of extreme interest payments for SBD savings. Let's imagine that the blockchain pays 100% APR on SBDs for a time period of 1 year. What would be the impact of such a crazy-high inflation rate?

FWIW, I think 100% is the max allowed

if( itr != props.end() ) { uint16_t sbd_interest_rate; fc::raw::unpack_from_vector( itr->second, sbd_interest_rate ); FC_ASSERT( sbd_interest_rate >= 0, "sbd_interest_rate must be positive" ); FC_ASSERT( sbd_interest_rate <= STEEM_100_PERCENT, "sbd_interest_rate must not exceed 100%" ); }

As before, I'm not proposing any course of action. I'm just putting forward a thought experiment to help us start getting a better understanding of the possible impact of interest payments.

All numbers here should be considered "back of the envelope" calculations. I'm just making rough estimates, and they could be wildly wrong. If so, please feel free to reply with corrections.

In particular, this thought experiment depends heavily on my understanding that SBD interest does not get paid to SBDs in the SPS wallet, currently 1/3 of all SBDs. If that assumption is wrong, all bets are off. 😉

Baseline

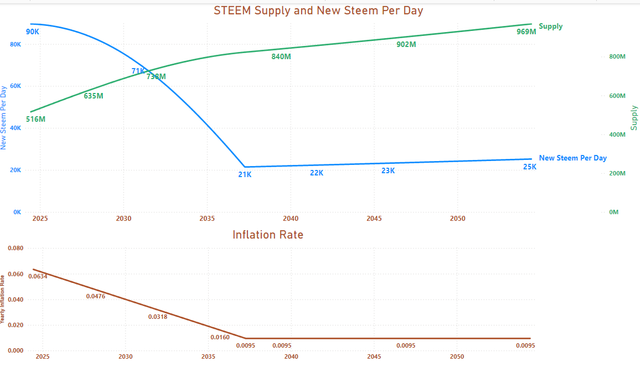

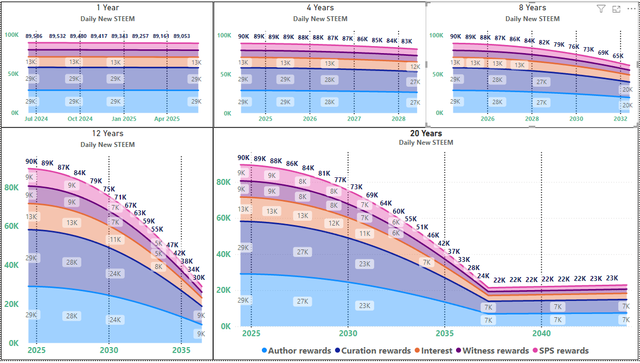

Here is how the virtual supply, interest rates, and new STEEM production are expected to look in the future with 0% SBD interest.

| _ | _ |

|---|---|

|  |

In short, the current virtual supply is 516 million, and in a year, the virtual supply would be 550 million (ignoring other factors such as possible STEEM price changes, token burning, and missed blocks by witnesses).

SBD supply information - before and after

Unfortunately, I don't have any visuals that can show the potential impact of SBD interest, so we'll have to look at the raw numbers. For the sake of today's post, "Liquid SBD" means SBDs outside of the SPS wallet. Here's what we see today:

Current values

- SBD supply: 13,422,915

- SBD locked up in SPS: 4,475,832

- Liquid SBD ([Row 1.] - [Row 2.]): 8,947,083 / 67%

- Contribution of liquid SBD to virtual supply ([Row 3.] * 4 STEEM): 35,788,332 STEEM / 7%

- Contribution of all SBDs to virtual supply ([Row 1.] * 4 STEEM: 53,691,660 STEEM / 10.4%.

The SBD print rate is currently 0%. Let's assume that adding SBD interest either hurts or doesn't help the price of STEEM. This means that the print rate stays at 0% and the price threshold to resume printing would go up. This is basically (I think) a worst-case scenario, and it also simplifies the calculation because we don't need to worry about SBDs from future posting rewards.

Now, what do the related numbers look like in a year? Let's also assume that every liquid SBD in existence goes into savings and earns 100% APR (never mind the impossible effect that would have on external market prices).

Other Assumptions:

- Liquid SBD paid in interest 8,947,083

- STEEM equivalent of SBD interest ( 8,947,083 * 4 ): 35,788,332

- Note that this is based on the current SBD print threshold, which (overly) maximizes the values below. In actuality, the SBD print threshold would increase, which would drive the SBD:STEEM conversion factor and the STEEM equivalent values to be lower.

New values in a year:

- SBD Supply: 13,422,915 (550/516) + 8,947,083 = 23,254,453

- Virtual supply = 550 million STEEM + ( 35,788,332 STEEM ) = 586 million STEEM

- Liquid SBD ( 8,947,083 * 2 ): 17,894,166 / 77%

- Surplus virtual supply: 36 million STEEM / 6.5%

- Contribution of liquid SBD to virtual supply ( 4 STEEM * 17,894,166 SBD): 71,576,664 STEEM / 12%

- Contribution of all SBDs to virtual supply ( 4 STEEM * 23,254,453 SBD): 93,017,812 / 16%.

- It's also worth noting that any substantial STEEM price increases above the SBD print threshold would dwarf this effect. For example, if the price of STEEM goes to a dollar, that would reduce the liquid SBD value to 17,894,166 STEEM and the overall contribution would reduce to 23,254,453 STEEM. In that case, the virtual supply would be roughly the same as today.

So, the potential downside at the blockchain layer is

- An increase of 6 1/2% in the virtual supply.

- A doubling of the supply of liquid SBDs, which would increase the percentage of liquid SBDs from 66% to 77%.

- A 9 million increase in the overall SBD supply (40%).

But that downside is countered by a potential upside of increasing the price of STEEM, which would reduce the virtual supply below these upper boundaries, and conceivably even below today's levels.

Caution

This is all vastly oversimplified. I hope that it captures the essential features, but it is definitely incorrect and incomplete. In particular, the conversion factor between SBDs and STEEM is constantly changing, and it ignores the possibility of distributions from the SPS wallet.

What happens at the social media layer?

I posted here about the effect that SBD interest might have on a variety of stakeholders, but the two key effects that I want to focus on here are both impacts on SP holders.

- SP holders who are currently delegating their holdings to delegation bots and posting overvalued content daily could get a better rate of return by simply powering down, trading their STEEM for SBDs, and putting the SBDs in savings to collect passive interest.

- Other SP holders who are not really interested in curating could go through the same exercise.

These powerdowns would have the follow-on effects that curators who continued curation would have less competition for curation rewards and SP interest, so their returns should go up.

Another follow-on effect from the powering down of delegation bot users would be an improvement in accurate valuation of content on the blockchain.

Last points:

- Curators can always reduce the SBD supply by giving preferential treatment to /promoted posts.

- If SBD interest gets turned on and it all goes horribly wrong, we can always turn it off again.

- If increased supply decreases the price of SBDs to below a dollar, the blockchain conversion function is available to reduce the supply and stabilize the price.

Conclusion

Is 100% the ideal rate? I doubt it. I also don't have any reason to believe that the current value of 0% is ideal. This is a question for the witnesses, why is your sbd interest parameter currently set to 0?

Again, I'm not proposing that anyone follow this course of action, but I am proposing that we need to get a better handle on the potential impact of SBD interest on the health of the Steem ecosystem. This is a potentially powerful lever that is currently being totally ignored (as far as I can tell).

The primary stakeholder who I can imagine would be opposed to such a strategy would be the delegation bot operators. However, their voting influence comes from their delegators, so their opinion almost doesn't matter. If it makes sense to act then the ones to persuade would be the delegation bots' clients, not the operators.

It has been about 3 months since I first started thought experiments on this topic. It would be useful to hear opinions and a more careful analysis from some of the top witnesses, who are responsible for understanding and setting this parameter.

It would also be useful to hear from the community. What are your thoughts on how to best make use of the sbd interest rate parameter to improve the health of the ecosystem?

Thank you for your time and attention.

As a general rule, I up-vote comments that demonstrate "proof of reading".

Steve Palmer is an IT professional with three decades of professional experience in data communications and information systems. He holds a bachelor's degree in mathematics, a master's degree in computer science, and a master's degree in information systems and technology management. He has been awarded 3 US patents.

Pixabay license, source

Reminder

Visit the /promoted page and #burnsteem25 to support the inflation-fighters who are helping to enable decentralized regulation of Steem token supply growth.

I haven't looked into it, but why wouldn't the proposal account also earn interest? (I guess it might not transact to claim it, though). You may also want to think about any exchanges that list SBD, they're probably large SBD holders from the chain's perspective.

I think you need to focus more on contemplating the market dynamics than things like token supply effects. I think ludicrous interest rates would have a tendency to make the chain look bad to outsiders (and if the chain looks sketchy enough it can start getting delisted or have the value crash in other ways). It's not at all clear to me that the bot businesses would flow their assets from SP to SBDs, why not just maneuver the price of Steem to guarantee SBD printing and use their SP to make sure they get a big chunk of the even-more-valuable-now SBD rewards? Also, the more valuable SBDs are the more tempting it could be for someone to raid the SPS funds, and if you're right about big holders powering down to get passive interest then more cheap liquid Steem would be floating around for someone to buy up to start controlling proposal (and witness) votes.

I'm not sure, but if I remember right, it only pays interest on SBDs in "Savings". I'm assuming that the SBDs in the SPS are not held in savings.

Perhaps, but I'm not sure if it would look more sketchy than our Trending page already does. And it doesn't need to be permanent. The main ideas that I wanted to explore here were: (i) the possibility of using interest rates to peel apart the interests of delegation-bot clients from the interests of the delegation-bot operators; and (ii) that I think the interest rate doesn't apply to all SBDs, just to the ones that are held in savings (which could still be wrong). But yeah, there are risks and tradeoffs to be managed.

If they did that, at least it would be good for the price of STEEM, even if the content quality stayed the same. In general, though, I suspect that most delegation-bot clients would prefer to have entirely passive rewards.

Those are both good points that I hadn't considered, although "cheap liquid Steem" here is not consistent with "why not just maneuver the price of Steem to guarantee SBD printing". The problem of "cheap liquid STEEM" could be managed, perhaps, by increasing the rate gradually in order to spread the powerdowns out over a longer period of time.

Also a good point that I hadn't considered. I'm sure you're right.

In the end, there's a big range between 0 and 100. I'd just like to see witnesses considering the full range of possibilities. Maybe I'm wrong, but it doesn't feel (to me) like anyone has seriously thought about this parameter in quite some time. We have a lot of experience to suggest that 0% doesn't do much to stimulate growth, but we don't know much about what happens at other values. Even the Hive example doesn't directly compare because they've changed many of their other rules, too.

I believe one of the Hive hardforks made it so only "savings" HBDs would earn interest, so presumably the behavior before that was that interest would apply to both savings and liquid HBDs, so I assume that's how Steem worked and still works.

I think things which are more clearly "finance related" are more likely to be considered newsworthy by the greater cryptosphere. People might not spontaneously investigate what the Trending page looks like, but information about changes in financial policy could be the stuff of news or rumors.

Right, for this point I was assuming for the sake of argument that your hypothetical was correct (which would imply that my hypothetical from the previous point was wrong).

Ah, I guess you're right. I thought I remembered seeing in Steemit's wallet that interest was paid on SBDs in savings, but not on the first SBD line, but I don't see that now, so could be wrong. It looks like they've removed all references to SBD interest now.

I do see it like that in upvu's wallet:

but that could be because they cloned the code from ecency, which had migrated to Hive.

So yeah, all bets are off... Thank you for catching that. I'll have to rethink things with that change in mind.

Greetings, Good to see you back! The sudden shocking dump of Altcoins was unexpected to me especially when we expecting bull market this year. I'll be happy if SBD reward will be continued,Honestly I don't have any expectation of SBD interest. Thanks for sharing the experiment with us, hope you'll share more!

I'll be happy if it just spurs the community to think about it. Maybe 0 is the right value, especially when the STEEM price is below the SBD print threshold - as now. But I think it's not the right value if it's not selected as a result of a reasoned decision-making process.

To be honest, your proposal does not give me peace 🙂. The temptation to give investors their profits while saving them from having to post tons of crap every day is very tempting. By cleaning the blockchain of overrated posts, we would make it more attractive.

So, let's say the community decided that interest would be paid on SBD. What should they be?

Most probably believe that it should be a small interest so as not to significantly increase inflation. Yes, inflation is bad. But a small interest will not attract anyone.

On the other hand, a large interest may attract many investors, but cause too much inflation. We know of some DeFi projects that offered crazy interest rates and collapsed because of it. However, these DeFi projects no longer had any basis other than large interest. Unlike them, Steem is a much more thorough project with its purpose, community and experience of passing incredible stress tests.

Since we need investors, I think we should give them what they want and buy the investment, so to speak.

I honestly don't know what to think, especially when the price of STEEM is below the SBD print threshold again. It's tampering with a complex system that has a lot of moving pieces. But, I feel like the topic has been ignored for too long. That's why I keep kicking up the dust... 😉

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

TEAM 5

Thank you, @o1eh!

I agree with what you say, bots require an entity that is the user, that's what I think, having an interest in SBD and any other asset leads to profits, if the price is already good I imagine the interests.

I was on this panel a few years ago, I'm coming back with the intention of investing, I like everything related to business, my business is metalworking, something I studied for 5 years and now is my time.

The idea of holding SBD and earning good interest on them is a good idea, it can also bring more investors

I have with me a team from Norway who have invested large amounts in steem and they don't write posts, they just curate.

The Hard Fork where we went to 50/50% was good for investors who just curate, but they also lost the opportunity to SBD when it prints. SBD is only paid out to those who write posts and my investors don't like that. 50/50 should be equal for both curators and authors with steem/SBD.

I am not sure how this would help the price of steem in anyway though. The SP holders that would be selling steem for SBD would very likely drive the price of steem to very low levels and inflate the price of SBDs to very high levels on Exchanges when they move from steem to SBDs. Neither are particularly good for the project imo, especially when SBDs are supposed to be a stable coin pegged to a dollar's worth of steem. Your point seems to be to get the large SP holders/investors out that are "farming" but once you get those holders/investors out, how much value does the project really have?! That is the question...