Thinking out loud: When should the witnesses start paying interest on SBDs in savings?

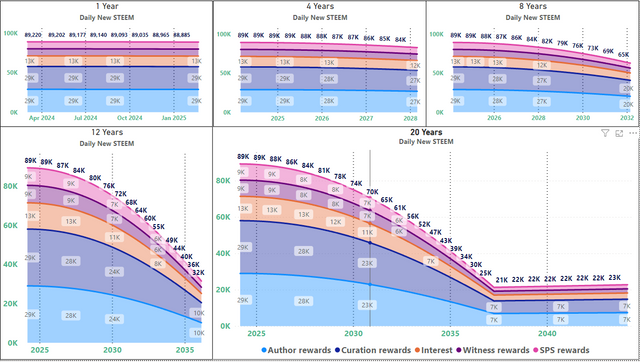

The other day I posted an update on Steem inflation. In that article, we saw that the expected daily STEEM production was 89,874 and that it was set to decline to ~22,000 over the course of the next 13 years.

In broad strokes, I'm fairly sure that the idea behind this inflation curve was to distribute STEEM widely for its first decade, and then to increase scarcity for another decade, and finally flatten off at a low, but steady and permanent rate.

However, something that worries me about this curve is that we see the rewards for witnesses declining from about 9,000 per day now to about 2,200 per day in 2037. This is (roughly) a 75% reduction. We depend on the witnesses to secure our blockchain, and if the price of STEEM doesn't go up, that's a pretty harsh decline. In order to maintain current income levels, the witnesses would need the price of STEEM to go up by a factor of four during that timeframe. Bitcoin has survived reductions like this, but every halving shakes out some portion of the miners. I'm not sure whether Steem has enough witnesses to support such a shakeout.

Further, let's look at what happens if the price of STEEM does go up. Here's the same graph as "Figure 1" in my previous post, 3 days later, after the price of STEEM crossed the haircut threshold.

Just $0.02 in price movement over two and a half days caused the daily rewards to drop by 654 STEEM, or 7/10 of a percent, and now the expected payout for witnesses in 2037 would be just 2,100 STEEM. Thus, even a 4x increase in the price of STEEM probably wouldn't get the witnesses up to today's income levels at the bottom of the curve. There's a lot of complicated math here, and we don't know what the future may bring as far as usage and investment, but I wonder if there's a point on the curve where the rewards will be so scarce that it won't be enough for even a top-20 witness to be profitable?

(If the STEEM price goes down again, the daily rewards will increase, but they'd never again reach the height of the original curve without some sort of intervention by witnesses.)

So, if a threat to witness profitability eventually arises from the blockchain economics, I'm wondering what the witnesses can do to remain profitable, and I have only come up with two answers:

- Implement a hardfork to give themselves a larger percentage of the rewards or increase the overall inflation rate.

- Increase the daily rewards without a hardfork by increasing the virtual supply by paying interest on SBDs.

All the way back in 2016, I made a Steem At A Glance graphic, where I noted that (at the time) SBDs were paying 15% interest, and we all know of a similar blockchain where their stable coins are currently paying 20%, so it certainly seems to be possible to implement option 2 with little difficulty. I believe that it's just based on a parameter that can be set by each witness.

So, assuming that the capability still exists, what would be the ramifications of such a decision?

Effect on delegation bot users

As we've discussed many times, most delegation bot users would probably prefer to have completely passive income. One solution to the problem of spam from this investor community was almost exactly this, as suggested by @michelangelo3, Wie wäre es mit einem Investorenaccount? (How about an investor account?).

So, with a high rate of interest for SBDs, many delegation bot users might be encouraged to stop SPAMing the blockchain and start earning passive interest, instead.

Effect on curators / curation bots

- Again, if the interest rate is high enough, many curators might decide to power-down their STEEM and convert to SBD for interest payments. In turn, this would increase the SP interest and curation rewards for the curators who remained.

- The total amount of daily curation rewards would be increased as a result of the increased virtual supply.

Effect on external SBD markets

I could imagine this going in one of two ways:

- SBDs are removed from the market and tucked away in savings, increasing scarcity, and therefore increasing the market price for SBDs on external markets; -OR-

- The increase in the SBD supply causes a surplus and reduces the price on external markets, until it eventually falls to a dollar, where it can be (imperfectly) regulated by the blockchain's internal conversion mechanism.

Effect on Steem authors

- The reduction in competition from delegation bot SPAM leaves more rewards for true content creators with a desire to cultivate audiences and communities;

- The SBDs that they earn on their posting (when the STEEM price is above the haircut level), might be more or less valuable. It's not clear to me which way that would go.

- The daily amount of rewards that are available to authors would increase as a result of the increase in virtual supply.

Effect on witnesses

- Without increasing their percentage of daily rewards, they would increase their block producer rewards.

- Anyone who powers down SP and shifts it to SBD would lose their voting influence, which could shake up the ranks of witness voting.

Effect on SP investors

- Selling by investors who switch holdings from SP to SBD could lead to downward pressure on the price of STEEM.

- Investments would be diluted by the amount of the increased interest, which could put downward pressure on the price of STEEM (which would increase the virtual supply even more whenever the price of STEEM is above the haircut level).

- Two interest-bearing avenues would be available. If the investor wants to evaluate content, they could invest in SP. If not, they could invest in SBDs.

- The reduction in SPAM levels from delegation bot users might offset some or all of the dilution and put upward pressure on the value of STEEM.

Technical effects

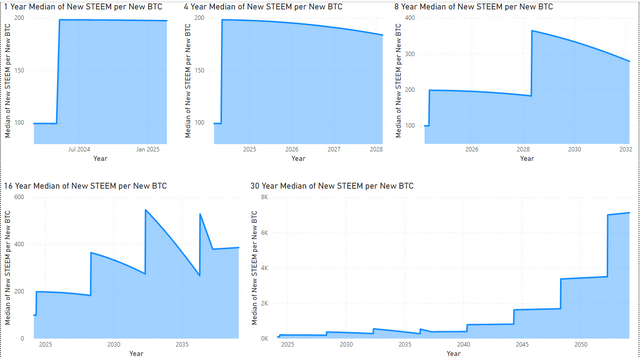

One of the things we have seen over the years is that STEEM's price can be influenced by BTC price movement. In recent weeks, I created this graph to compare the ratio of [new steem per day] / [new BTC per day], according to the two blockchains' inflation formulae.

As a result of BTC's halving cycle, there is a 4 year sudden doubling in new_STEEM/new_BTC that might produce some sort of a price shock. By paying a lower interest rate immediately after a halving and increasing it smoothly over the four year cycle, is it possible for the witnesses to use SBD interest to smooth out the impact of BTC's 4 year cycle in order to reduce the shock from BTC halvings? (and if so, is it desirable? I haven't thought this through at all.)

It's also worth noting that the SBD supply is currently around $13 million, and nearly 1/3 of that is locked up in the SPS, so the scope of these interest rate changes is currently limited to a total of about 9 million SBDs (which would - of course - increase with interest payments and author SBD rewards).

Conclusion

When should the witnesses start paying interest on SBDs? I'll be the first to say, "I don't know".

But, I think that the witnesses should start thinking about the possibility (if they're not already). At some point in the future, I think it might be a good decision - and potentially even necessary. In my opinion, it would be prudent for the witnesses to start deciding now what conditions would trigger it, instead of rushing it through during an unanticipated crisis.

If the witnesses decide to do this, there are possible benefits to authors, curators, investors, and the witnesses themselves. Of course, there are also tradeoffs, so the decision needs to be carefully considered.

What do you think? What are the conditions that should trigger the witnesses to reenable SBD interest payments (assuming that the parameter is still functional under HF23)?

Thank you for your time and attention.

As a general rule, I up-vote comments that demonstrate "proof of reading".

Steve Palmer is an IT professional with three decades of professional experience in data communications and information systems. He holds a bachelor's degree in mathematics, a master's degree in computer science, and a master's degree in information systems and technology management. He has been awarded 3 US patents.

Pixabay license, source

Reminder

Visit the /promoted page and #burnsteem25 to support the inflation-fighters who are helping to enable decentralized regulation of Steem token supply growth.

Very interesting topic. I've been thinking about this myself, as I'm interested in anything that can reduce spam and bot exposure.

I tried to simulate a situation where witnesses started paying interest on SBD right now, during a bull market. What could potentially happen?

This is just an attempt to simulate the situation. Of course, witnesses will not try to compete with bots, because they do not need it. If they start paying interest on SBD, it will be for other reasons.

Good point. I already mentioned the uncertainty about the price of SBDs, but I should have mentioned the selling pressure on STEEM, too. I just added that to the main post.

I also suspect that in the long run, this would drive the price of SBD back towards the peg, but I think it all depends on whether investors and authors sell or save the SBD that they receive in interest payouts and author rewards.

I'm not sure I really follow the argument about the relationship between this and STEEM price or witness incomes. In general I think they should stick to the basic premise: turn on interest when there's insufficient demand for SBDs, which doesn't seem to be the case today.

If whatever price manipulations are keeping apparent SBD prices far above 1 USD were to be broken and SBD prices floated down to below 1 USD then "investors" could stay liquid and make money by doing SBD->STEEM conversions. But I think some people are under the impression that having high SBD prices are good for their vote-bot businesses.

The amount of new STEEM produced is based on the virtual supply, according to this formula:

And, of course,

So, if we increase the SBD_supply, that increases the virtual supply, and that increases the new_steem to be distributed in the form of rewards. Not just to witnesses, but to witnesses and all other participants, too.

The part about the virtual supply changing as the price of STEEM changes was introduced by @dan, here and I wrote on it here. The crux is that a rising price of STEEM decreases the 2nd term of the virtual supply equation, above, and a falling price of STEEM increases it.

In general I would agree that interest is a tool to stimulate demand, but there seem to be other relevant factors at play in this situation (as you also note): (i) The high price for SBD on external markets is stimulating spamming at the social media layer; (ii) The SBD was intended to be stable, not to float with market rates; and of course the point I made above (iii) that being a witness needs to be profitable for the health and safety of the blockchain. In this particular case, the high external price is almost like an attack that prevents the blockchain from acting as designed. Increasing the supply with interest payments might have two effects:

I'm not arguing for SBD interest payments at this point, but I do think it deserves careful consideration, because there are more factors in play than just supply and demand for the SBD.

OK, looking at those formulas, wouldn't the SBD inflation rate need to be huge to have a non-negligible effect?

In the abstract I think the chain would probably be better if the witnesses could dynamically adjust some of the economic settings (inflation rates, how much is allocated to each pool, etc.), but obviously that's not how things currently work. Since this one is one of the few settings that currently can be altered without a fork I can see why it's worth considering whether anything useful can be done with it, but to me it seems like the wrong tool for this job.

Well, it was intended to float with market rates with the expectation the conversion mechanism would incentivize it float toward $1. Perhaps that's a pedantic point, but a lot of people seem to think there should be a centralized mechanism to maintain the peg even though the original decentralized idea is better (most of the time when I suggest we'd be better off if the price went below $1 people act like that would be a crisis rather than the normal thing that the chain is already designed to deal with). Of course the original idea was based on the premise that there would be some economic sense to what was going on, instead the prices of small-cap coins seems to be dominated by the actions of manipulators, speculators, and fads rather than conventional economics.

I haven't worked through the numbers, but I do think they'd either need to be fairly large or long lasting or both. I mean, back-of-the-envelope, 20% would double the supply of SBDs in 5 years (not counting compound interest or SBDs not in savings).

I agree with this. But yeah, not happening any time soon.

Yeah, I don't necessarily disagree. That's sort of why I titled the post and phrased the question the way I did. Basically, we have this parameter sitting out there that everyone is ignoring, and it has potentially wide-ranging influence. I don't think we should just turn it on and see what happens, but I think the witnesses and the rest of the community should start thinking about how and when to make use of it.

This is another point. The larger the market, the harder it is to manipulate. I've never traded in penny-stocks, but I have the impression that a lot of manipulation happens there, too.

Your post has been successfully curated by @𝐢𝐫𝐚𝐰𝐚𝐧𝐝𝐞𝐝𝐲 at 40%.

Thanks for setting your post to 25% for @null.

We invite you to continue publishing quality content. In this way, you could have the option of being selected in the weekly Top of our curation team.

Thank you, @irawandedy.

This post has received a 100.0 % upvote from @boomerang.

Thank you.

This is an interesting topic, though one I don't think we should be worrying about right now with a new bull market just starting, and it being 2024 currently. A lot can happen between now and the next decade or so. I think this is something we revisit in a couple years when it becomes more of an issue so we don't risk messing things up doing things we didn't technically need to do right now anyways. Just my thoughts.

Play in the summer, starve in the winter. 😉

I agree that we shouldn't rush into anything blindly, but I don't think we should wait a couple of years before we start trying to understand it better. Perhaps I'm wrong, but I don't get the sense that even the original developers understood the full implications of interest rate changes. It may be that when we understand it better, we would want to make changes sooner rather than later.

It's counterintuitive, but if SBD interest payments happened to boost the price of STEEM, it's conceivable that printing SBDs at some optimal rate could actually increase scarcity and protect witness profitability at the same time. (Though, I haven't done the math to find the conditions where that might happen.)

Haha I knew you were going to say something about preparing for the future etc... While normally I would agree with you, I think it is something that is so far away, it is not worth spending time on today. To continue your analogy above, perhaps it is something best worked on in the winter indeed. ;)

Well, I think we can agree that it's not an urgent need, and we can probably agree on a handful of other things that ought to be higher in priority. But, I think this is a foundational responsibility of the witnesses -- at least for the top-20 witnesses. This is what the blockchain pays them for. IMO, in an ideal world the top-20 witnesses would:

If that parameter is set to zero simply because, "It has (almost) always been done that way", then a better understanding is needed. If there's a reason to leave it at zero, fine. But it shouldn't be pegged there just because no one thought about it.

I agree! Thanks for voting us 🙏

Visit our recent work: Steem dapp service 'Steemblocks' https://steemblocks.com/

Available features:

We also have seed node and API node running and monitoring properly.

2.https://api.dhakawitness.com/

Thanks again for your kind support 🙏

TEAM 1

Congratulations! This comment has been upvoted through steemcurator04. We support quality posts , good comments anywhere and any tags.