ICONOMI: Undervalued?

With Alt-Coin valuations at all time highs, it’s hard to spot a bargain amongst the wraft of cryptocurrencies posting 100-1000% gains Year on Year. This being said, I believe ICONOMI represents great value at it’s current price around 0.0005 BTC.

Market Cap

The market cap of Iconomi is ~$114,000,000

Share Structure

Unlike the vast majority of cryptocurrencies, ICN Tokens represent 100% ownership of the ICONOMI platform.

ICONOMI will issue 100 milion ICONOMI tokens (ICN) 10 days after the crowdfunding campaign successfully ends. 100 % of the ICONOMI tokens represent 100 % ownership of the ICONOMI platform, comprising of all assets and liabilities, as well as each and every right and obligation, including but not limited to intellectual property rights, branding and trademarks. ICONOMI Whitepaper

Most ERC-20 tokens represent a network token, and zero ownership in the holding company. This allows ICN owners to directly benefit from the appreciation of underlying Token Value held by ICONOMI, along with the revenue generation from their trading activity. It also completely aligns the founders interests with the ICN token holders, which is something which is becoming increasingly important.

Net Asset Value

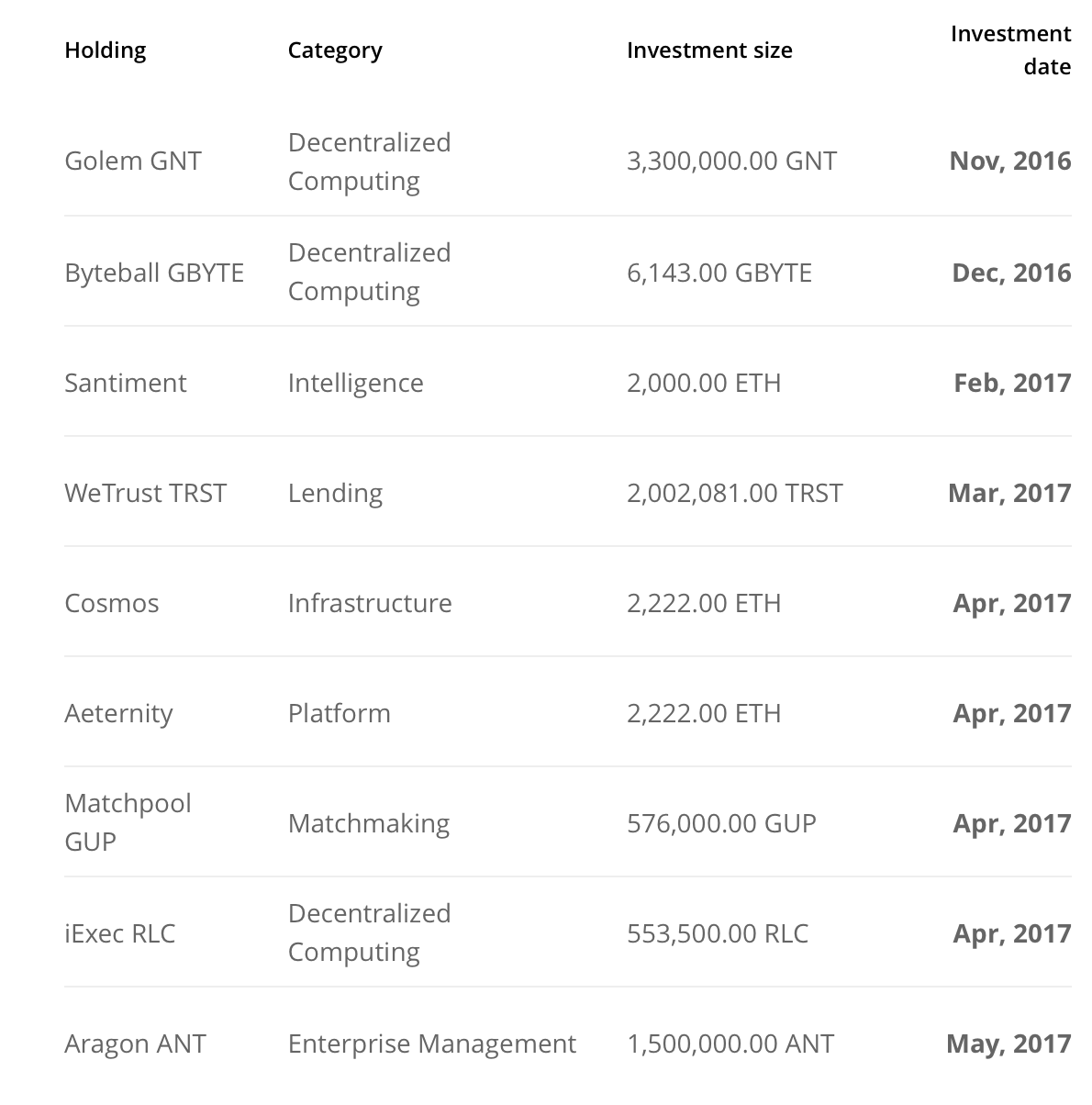

Here is where things get exciting, because the tokens represent share ownership in Iconomy, ICN have a tangible value, being the underlying assets held by, and managed by ICONOMI. All of these funds can be summarised by looking at uninvested Funds, and the value of the ICNP fund ICONOMI manage on behalf of ICN token holders.

Univested Assets:

Bitcoin: 2897 BTC: @$2557: $7,465,569

Ethereum: 64,798: @$243: $15,745,914

Lisk: 1,729,538: @$1.63: $2,819,146

USD: $53,433

Euro: €1,081,275: $1,218,110

ICNP: $38,725,867

Valuing Satiment, Cosmos, Aeternity at Cost, which is most likely very conservative

$66,028,039 Net Asset Value

In the current cryptocurrency landscape, there are not many tokens which represent a true claim on ~50% of the Market Cap, in Net Asset Value. For this reason, along with the future goals of this company, I believe they represent great value at current prices. I would however urge everyone to do their own due diligence before decide to invest.

Shareholder Returns

Iconomi will be returning capital to shareholders in the form of share buybacks, and this has already taken place as a result of profit's generated from the Golem investment. This means that there will be a natural demand for ICN tokens on the buy side, and also the token will natural become more scarce over time.

Following is some information regarding ICONOMI's future development goals.

What is Iconomi?

Iconomi are building an Open Fund Management Platform.

The essence and vision of the ICONOMI project is the ICONOMI Open Fund Management (OFM) platform for investing. OFM is a simple management tool where traders with knowledge and experience create their own investment funds. Investors, on the other hand, are able to invest even the smallest amounts, getting a clear overview of available investment fund managers and their current & past performance. Iconomy Whitepaper

With so much fresh capital flowing into the cryptocurrency space, I can only see this being successful. New investors to cryptocurrency will be able to invest in experienced, successful cryptocurrency traders/investors, without having the counterparty risk of trusting an individual they have never met (ICONOMI will be managing the assets on behalf of both sides of the transaction). Whilst the experienced cryptocurrency traders will be able to set up funds, accept investment, and earn performance fee’s for generating returns for their investors.

If you think of the friction which is involved you trying to replicate this business model in the convention fiat economy, it’s easy to see how the could be very successful.

On top of this, ICONOMI also manages 2 fund themselves.

ICNX

The ICNX measures the performance of digital assets that meet certain eligibility criteria. The ICNX DAA constituents and their corresponding weights are updated on a monthly basis or more frequently due to the fast changing environment of the digital assets market. Digital assets currently included in the DAA represent 92% of the total market capitalization of all digital assets. ICONOMI Website

This fund is designed to track the boarder performance of the Cryptocurrency economy. It currently has ~$500,000 of investor funds under management in closed beta, and has achieved returns of 124% MoM. This generates revenue for ICONOMI based on a 3% management fee, and a 0.1% entry/exit fee.

ICNP

ICNP connects supporters’ digital assets with the best distributed economy startups and other lucrative opportunities. ICNP is an actively managed DAA with a higher performance target, lead by a team of experts conducting thorough research and due diligence. ICONOMI Website

This fund essentially invests in ICO’s. Investors benefit from ICONOMI's buying power (negotiating prefunding deals), but also their expertise of finding the best new crypto startups to invest in. This fund is currently managing Iconomi ICO funds and has returned 126% MoM. This generates revenue for iconomi based on a 20% performance fee.

ICONOMI Debit Card

Iconomy are also working on have an Debit Card which will allow users to spend invested funds like it was cash in the bank. This would be a big leap forward in providing true liquidity to investors in managed products.

##Interested to hear anyone's views on the future of ICONOMI, and whether they represent a good investment opportunity at present...

I own some, because I bought during the ICO, but there are two things that prevent me from buying more:

a) Why pay them 2%+ in fees to do this when I can diversify a portfolio given their public investment breakdown on a certain exchange given their numbers and avoid the fees? i.e. I could go on poloniex and own 15% btc, 15% eth, GNT, DASH, XMR, SIA, and their other coins in the prescribed ratios

b) How is our money insured? Crypto may or may not be in a bubble right now, but if it bursts and the fund drops a huge amount, what prevents the people holding our coins from running?

Also curious how the fees work, are they amortized after someone sells? Or on a regular schedule? i.e. if we have $1000 at start then $2000 end of month one, do they deduct fees then, and if it drops to $1000 again we lose money despite fund being even?

a) Certainly, if you understand cryptocurrency, and have been in this space for sometime, then you might decide you can do a better job yourself. I will use it as a diversification tool. 3% Management fee is for me, a small cost for the level of diversification you gain..

b) Certainly there are consideration here. I assume here that, if you put your money into ICNX, as long as they have outflow measures, your money should be as safe as it would be at Coinbase (but granted, that is not ideal).

Performance fee for ICNP will be charged on EXIT

Management Fee will be charged annually against your holding

My investment case is more base around assets the company currently own, with the additional revenue to come in the future.. Your points are certainly justified though...

I agree, the 3% is reasonable considering some of the other projects like ShapeShift's Prism. High fees for the ease of diversification. They have the counterparty risk.

You seem like you know what your talking about, I need more of that; following.

Interesting counter-arguments. I guess some people want instant diversification without having to deal with many different coins / exchanges, but I would personally tend more towards your approach, i.e. just manage a diversified crypto portfolio that I directly control.

@hisnameisolllie (adding here to avoid double commenting)

Yes, it is easy and instant, but when they post what they invest in and their index weights, it is pretty easy to copy and rebalance weekly. Wouldn't even have to figure out what to invest in on your own.

I definitely won't be pulling my existing money out of iconomi, but I may just use my poloniex account to diversify in the same manner they do. That said, there are a finite number of ICN tokens, and more are not being created, so I suppose it is possible the coins could be worth more than how well the fund does? Or is that not true?

You're right, with limited number and their own buybacks, the tokens might be bid up. I think you did well to wade in at the ICO to have a stake, but as you say, quite a few uncertainties. Who can even guarantee that their portfolilo allocation is superior? If there is a human factor involved, then the result might be similar to stocks, where over 90% active managers underperform the overall market...

@cloudzombie: Yep, certainly understand that point of view. I think ICONOMI's success will come in on boarding crypto noobs....

and to @daut44 point, ICN token will represent the underlying net assets value, plus a multiple on current/future earnings...

I am more interested in the ability to simply create portfolios for others to buy into.

Nice criticism, following ya!

This is where I saw the most utility. 3% to me is a high fee to charge for managing a crypto fund. There's no way I'd allow that from someone managing my stocks/bonds (and thus why I manage my own).

With that said, high cost fund managers exist because they are utilized, and this will work because it fulfills a a lazy investment niche.

Thus, if I could create a portfolio offering that has a proven track record, why not provide that.

Yep

I can't wait until they release more.

I presume I can sign up for a mailer for when more will be released?

Yep, I believe they have a subreddit too.

I am also invested and share similar concerns. Not much though. I would rather have my money in a platform like iconomi rather than an exchange.

Alot of your questions are answered in the newest AMA for Iconomi on Reddit that just happened yesterday. One of them which I recall clearly is that they ARE adding insurance.

This post received a 13% upvote from @randowhale thanks to @hisnameisolllie! For more information, click here!

ICN is severely undervalued. When all the smoke clears the market will look at valuations more than ever before. Many hyped coins will crash and burn when investors finally realize there is nothing there. Steem is undervalued too.

great info...thanks for sharing...

I've changed my mind. They have more power to invest in ICOs at a discount, and holding just one stock over doing it myself increases my productivity by reducing the amount I am checking and agonizing over the tickers. Not to mention, BTC/ETH are pretty high right now and ICN hasn't seen the same gains since the last dip so it should have a lot of value with either.

I agree this is an interesting one. Are you worried they will be deemed a security or money manager and face some regulatory blowback? On its surface seems like they have a good chamber to win the index of crypto sweepstakes. I posted here on what it would mean for cryptocap if they ever become a dominant force

I think regulation would solidify their position as the go to 'Crypto Currency Money Managers'. They are the only company who have the resources to comply to regulation if it ever arrives IMO...

Look at aeternity and cosmos investments. this shows that they are just shooting numbers without actual research or optimization whatsoever.

I like Aeternity and Cosmos. Think they represent good investments. Is your problem just with the fact they invested 2,222 Ether? I would imagine that number represented X% of their Ether holdings...

Round numbers tells me the portfolio mgmt is not very efficient.

Their value proposition is not management though. So yes the platform can succeed and ICN can increase in value.

I've only been analyzing the top 20 by Market Cap, as far as good deals go, so I took a look at ICONOMI to compare.

And this would rank 4th out of the now 21 I've considered. Golem, Ripple, and NEM were the top three.....I did go out and get some Golem today, and I think having a little something in ICONOMI wouldn't be a bad idea.

totally undervalued, as soon as the site is up people will buy it for 10$, but hey thats what i love about crypto, if youre smart and fast you always have an edge over the slow moving mass

Iconomi is one of my preferred holds. I think it could be the DOW and S&P500 of the crypto-world. did you see how much they made from Byteball alone--and they got all of their Byteball for FREE! the platform is released to the public in TWO months. There was an AMA yesterday on Reddit in the Iconomi forum, which I would recommend. Followed and upvoted. All the BEST!