Millennials Have Been Financially Screwed - Massive Economic Repercussions To Come

It's difficult to overstate just how badly the Millennial generation are doing relative to their Baby Boomer parents. Regardless of the financial or economic metric you look at, the outlook is grim. A recently released report, using data from the Federal Reserve (and therefore, highly likely to underestimate the magnitude of the problem) is only the most recent confirmation in what is beginning to feel like one of my most frequent complaints about the current financial system.

Net worth is as "good" a place as any to start. Using the Fed's own numbers, Millennials are worth only $10,900 compared to Boomers' $25,035 at the same age. That's almost 150% more for the Boomers, and holy hell is the outlook bad when you correct for a realistic inflation rate. Boomers were probably worth more than triple, or even quadruple, in real goods at the same age as Millennials today.

That's not too surprising when you consider how annual expenses work and look at the difference between Boomer and Millennial salaries in 1989/2013. Boomers made $50,910 annually vs. the Millennial's $40,581 in 2013. Let's not even get into the difference in real purchasing power we'd see if we corrected for a non-hedonically adjusted inflation rate.

"But Lexiconical," you stammer, "aren't the Millenials a better educated generation, going to college and graduate school at record rates? Won't this long-term approach result in the tortoise overtaking the hare in the long race of like?"

In a word, no. This whole "education" story you've been sold recently is a bunch of hooey. Despite the massive amount of student loans this generation has been forced into on the railroaded-path to permanent financial servitude, we are still making substantially less in 2013 than Boomers were with similar credentials. Millenials with degrees averaged $50,000 - better, but still less than the average Boomer, most of which had no degree.

This just drives home a point I was telling students a decade ago - today's Bachelor's Degree is yesterday's High School diploma. Little did I know I was actually under, not over, selling the magnitude of the degree inflation caused by shoehorning endless students with no long-term plan into six-figure debts for Macrame and Gender Studies degrees.

It's no surprise that cryptocurrencies are most popular with the Millenial group. They are the ones most in desperate need of an escape from the fiat-inflation value extraction cycle perpetuated by most corporations mainstream governments.

I guess this is where one might say "buy Bitcoin."

The effects on the global, US $ based financial system when Millenials are expected to take over the crown of "economic core/primary spenders" are going to be disastrous. The money simply won't be there.

It will either be gone, or on a public ledger somewhere, in blockchain form. Bad news for future Bear Stearns/Lehman Brothers 2.0.

Disclaimer: This is not financial advice and I am not a financial advisor.

We also have a Radio Station! (click me)

...and a 10,000+ active user Discord Chat Server! (click me)

Sources: Google, Young Invincibles.org, US Census, US Federal Reserve, Fortune, ZH

Copyright: YoungInvincibles.org, TheCollegeInvestor.com, Reddit

You are telling me, it is getting really bad here in Toronto.

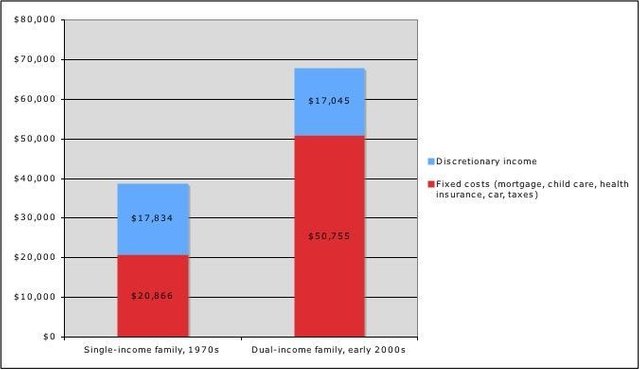

Asset price inflation has been the greatest negative for Millennials. Using California numbers (I know high cost of living) the average home price is 10 times the average income. Historically people were able to purchase homes at 3 times income. To save a traditional downpayment, fund retirement and pay for all other basic living expenses is an impossible task on income that has not increased since the 70s. Basically unless you were smart enough to study, understand and excel at Computer Science you are screwed.

Central bank creating asset bubble after asset bubble is the worst thing to happen in the 21st century. #endthefed

deleted

I'm from the generation just before yours, and it's not much better for us. For what it's worth, we're the ones the media used to lament about, yet somehow we have survived and aren't all homeless or drug addicted. We are however deeply in debt, working too many hours, neglecting children sent to crumbling schools in which teachers are losing interest in teaching, completely insecure about retirement, while also taking care of aging parents. Some of us own homes, but many can only afford it if we first work in a big city for a decade or two, then move away from the life we've known to start over someplace less expensive. (That's what I'm about to do.)

I think the problem is that the raison d'etre of neoliberalism is to lower the cost of production to as close to zero as is possible, and human labor is the primary cost of production. So since we switched away from Keynesian economics to NL in the 70s we've been in a slow death spiral. It can't improve for us if the system is in fact doing what it is designed to do. We're just in general too poorly educated to actually understand what it is designed to do, so you have people basically voting for their own exploitation.

Crypto to the rescue! Seriously, I do think that it is the trump card in the deck. That's why it frightens the hell out of so many of the old guard. How will they get you to volunteer to serve in their army to protect their access to exploited global resources if you aren't pretty much an indentured servant?

Many people are in the same boat. Here in Melbourne, cost of housing in established decent areas are pushing a million+ you can still get something for 450k if you dont mind living 45mins from cbd on a 200m block in a paddock, you know developers paid nothing for.

Its good information. I agree with your blog. Thanks for sharing such a good post.

Most millenials I know drive a nicer car than I can afford.

Economic vampires everywhere, hoarding money & spending it only to create systems & laws to take more from future generations. They create heirs with huge fortunes, but the world they leave behind to live in only gets worse & worse for everyone, heirs included.

The next planned “collapse” will result in even more economic inequality, more debt for the bottom 90% & those 1%ers everyone complained about for a little bit, will turn their billions into trillions. The “hippy” generation was laughed at & moved to the suburbs & became critically indebted by banks promising them prosperity.

You can’t take money with you, might as well use those resources to create a better world before you leave.

Yep.. I guess I'm still considered as a millenial depending on when you start counting (35 y/o right now) and I certainly always have felt that my generation is fighting an uphill battle. Everything is owned, every good job is taken. I've never had an actual non-temporary contract, and my net worth is so low that I'm not even going to mention it here. It's not that I don't have skills or abilities, as I am university schooled like the millenials in your post.

I think Bitcoin is indeed going to shake things up though. This is one thing that millenials do get and which older generations don't seem to get.

With Bitcoin and blockchain millenials, often seen as a kind of 'useless generation' are going to end up revolutionizing the world in ways that other generations can only dream of, it's going to turn out I think.

Curious to know Lexi, what age are you? Since you wrote about a decade ago!

I think I might be a millennial but Im not sure.

That's why I am working at a factory and commuting to pay my way through college. Won't take out another federal student loan after my first semester. It is immoral to have debt you do not expect to pay and it is immoral how US debt is backed. I may lack a social life now, but once I am out of college, I will have nearly complete economic freedom and a degree in CS backed by real know how knowledge.